Tax tips

Celebrating Memorial Day with a Roth Conversion? Here’s When It Makes Sense

Memorial Day marks more than just the start of summer. It’s also a smart checkpoint in the year to revisit your finances — especially your retirement strategy. One question you might be asking:Should I do a Roth conversion now? The answer depends on timing, income, tax projections, and your long-term goals. What Is a Roth…

Read MoreShould Doctors Consider Personal Loans? Here’s When

When it comes to financial management, doctors often face unique challenges. From managing student loans to establishing their practices, physicians need smart solutions. Personal loans can be a useful tool, but they aren’t always the right choice. Let’s explore when doctors should consider personal loans and the associated financial implications. What Are Personal Loans and…

Read MoreStrategies to Reduce Your Tax Liability

Taxes can feel like a heavy burden, but there are many ways you can reduce your tax liability if you take the right steps. Whether you’re a business owner, a high-income earner, or just someone looking to make the most of your finances, understanding tax-saving strategies is crucial. In this guide, we’ll break down the…

Read MoreHow to Evaluate a Rental Property: 5 Essential Rules

Investing in rental properties can be a lucrative venture if done correctly. However, to ensure your investment provides consistent returns, you need to evaluate potential properties carefully. The following five essential rules will help you make informed decisions, backed by practical and actionable insights. 1. Analyze the Location The location of a rental property is…

Read MoreThe 10 Biggest Pitfalls of Tax-Loss Harvesting

Tax-loss harvesting is a powerful tool for reducing tax liability, but like any strategy, it can go wrong if not executed properly. Understanding its pitfalls is crucial for investors who want to use this technique effectively. This post will explore the 10 biggest mistakes investors make with tax-loss harvesting, explain how tax advisors can help…

Read MoreWhen Does a Roth Conversion Make Financial Sense?

A Roth conversion lets you shift money from a pre-tax retirement account into a Roth IRA. The trade-off: you pay taxes now in exchange for tax-free withdrawals later. Done strategically, a Roth conversion can lower your lifetime tax bill, reduce required minimum distributions (RMDs), and give you more control over retirement income. But the benefits…

Read MoreHigh-Income Earners: Should You Use a Deferred Compensation Plan?

If you’re a high-income professional—particularly a physician—you may be looking for ways to reduce your tax burden while building long-term wealth. One overlooked tool that can help is the deferred compensation plan. But is it the right move for you? Let’s explore how these plans work, how they benefit high earners like doctors and executives,…

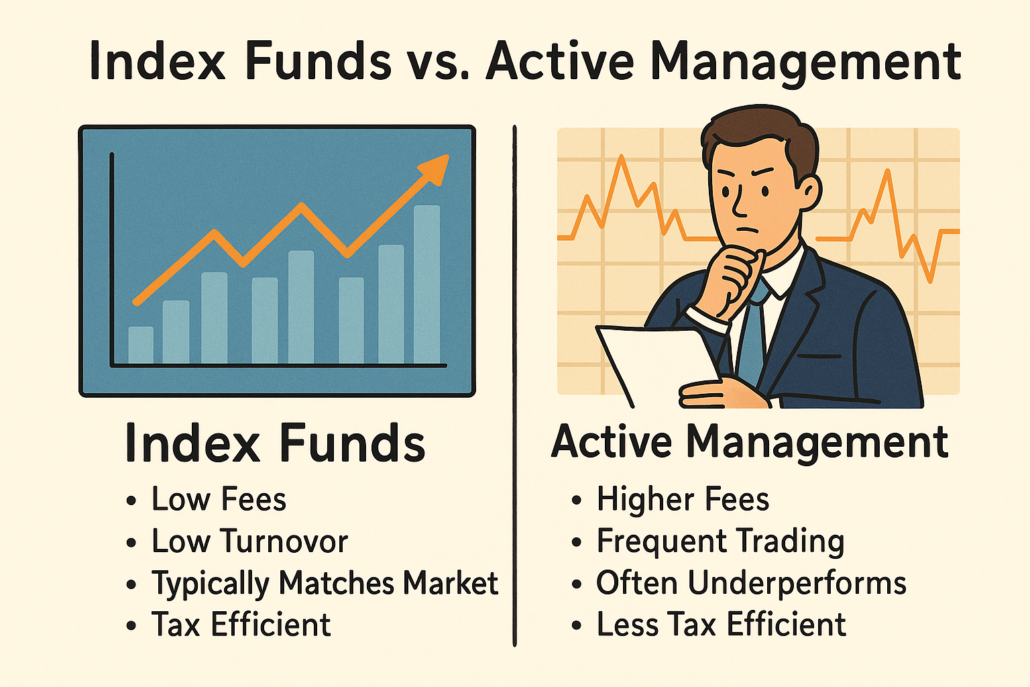

Read MoreIndex Funds vs. Active Management: What Really Wins

If you want to grow your wealth without unnecessary risk or tax drag, your investment strategy matters. For high-income professionals, especially physicians, choosing between index funds and active management isn’t just about returns — it’s about efficiency, control, and long-term outcomes. So, what actually wins in the long run? Let’s break it down. What’s the…

Read MoreBuild Wealth Without the Tax Hit: 10 Investment Picks

Want to grow your money without handing a big chunk to the IRS every year?Smart investing isn’t just about returns. It’s about what you keep after taxes. Here are 10 investment picks and strategies that help you build wealth tax-free or tax-deferred, backed by real tax planning and proven results. We’ll also show you where…

Read More10 Investor Mindset Shifts to Handle Market Losses

Market downturns test even the most disciplined investors. When portfolios shrink, fear takes over. But emotional investing mistakes rarely lead to long-term success. The right investor mindset during a market crash helps you stay focused, minimize losses, and even uncover new opportunities. Here are 10 shifts you can make to keep your investment strategy on…

Read More