Tax tips

Moving Closer—or Further—from Financial Freedom?

A few years back, a friend texted me a photo of his brand-new sports car. It was red. Shiny. Gorgeous. A month later, he was complaining he couldn’t afford to max out his retirement account anymore. Another friend—same income, same job title—drove a sensible sedan, invested every bonus check, and recently told me she’s contemplating…

Read MoreHow to Identify Your Biggest Financial Threat

A friend of mine used to say, “I’d rather face a lion than look at my finances.” I used to laugh—until I realized a lot of people feel the same. Lions roar and bare their teeth. Financial threats…they’re quiet. Subtle. They hide in spreadsheets, interest rates, and decisions you meant to make “next month.” And…

Read MoreCould You Pay Less Tax Under Trump’s One Big Beautiful Bill?

Well, here we are. Trump’s “One Big Beautiful Bill” is now the law of the land. I have to admit—just a couple years ago, I’d have bet this was more political rally talk than a real piece of legislation. But Congress actually passed it, and it’s… big. And kind of beautiful, depending on who you…

Read MoreAre Your Habits Helping or Hurting Your Financial Freedom?

Years ago, a friend of mine bought a fancy new espresso machine for $1,200. She called it an “investment.” She used it twice. Meanwhile, another friend socked away $20 a week into a Roth IRA and, last I checked, had almost five figures saved—just from coffee money alone. Same income levels. Totally different financial outcomes.…

Read MoreSaving Money When Your Insurance Premiums Go Up

I remember opening my renewal notice once and blinking twice, thinking my eyes were playing tricks. My car insurance premium had jumped almost 20%. No new claims. No new tickets. Just… up. Sound familiar? If your insurance costs are rising, you’re not alone. It’s happening everywhere—from auto and homeowners insurance to health coverage. Let’s unpack…

Read MoreTop 5 Summer Tax Tips for Consultants and Coaches

Summer might not scream “tax planning,” but that doesn’t mean it’s a time to go quiet on your finances. If you’re a consultant or coach, this season offers a clean break from tax season chaos and a chance to get ahead of your 2025 tax bill. Think of it as a mid-year checkup before anything…

Read More10 Smart Summer Tax Moves to Shrink Your 2025 Bill Before It’s Too Late

Summer isn’t just for cookouts and vacations. It’s actually the perfect window—calm enough, early enough—to make smart tax moves before the year starts slipping away. You don’t have to overhaul your finances or spend hours in spreadsheets. But if you wait until the fall (or worse, winter), the choices shrink fast. This is about small,…

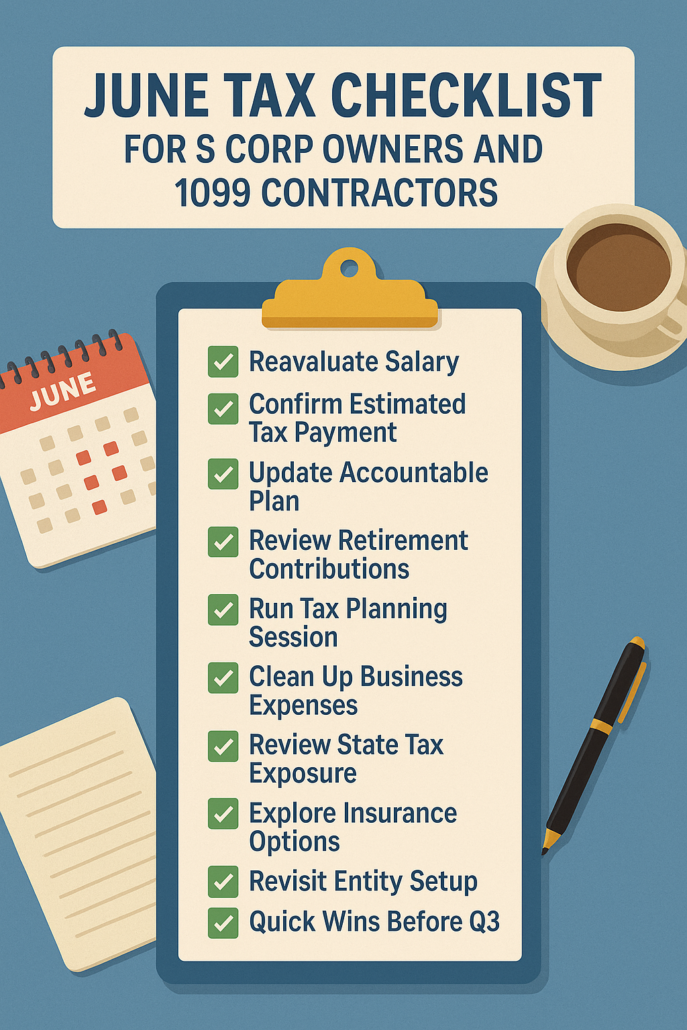

Read MoreJune Tax Checklist for S Corp Owners and 1099 Contractors: What You Need to Do Now

June doesn’t get much attention in the business world. It’s not tax season. It’s not year-end. But for S corporation owners and 1099 contractors, it might be one of the most useful months to reset. Quiet? Sure. But also—ideal for catching small problems before they become expensive ones. So if you’re running an S corp…

Read MoreWhat You Should Be Doing Right Now: Tax and Retirement Planning Mid-Year

We’re halfway through the year. That weird middle ground—too late to say “I’ll deal with it later,” but not so late that you’ve run out of options. If you’ve ignored your taxes or haven’t touched your retirement plan since January, now’s your window. Mid-year is when your numbers are real, not just guesses. And with…

Read MoreSummer Money Goals for High-Net-Worth Professionals: What to Prioritize Now

Summer’s a strange season for high-net-worth professionals. On one hand, things tend to slow down—colleagues and clients are on vacation, and the inbox gets a little quieter. But it’s also when smart financial minds get to work. While others are mentally at the beach, you can take advantage of the mid-year lull to tighten up…

Read More