Posts Tagged ‘physician tax strategies’

Could You Pay Less Tax Under Trump’s One Big Beautiful Bill?

Well, here we are. Trump’s “One Big Beautiful Bill” is now the law of the land. I have to admit—just a couple years ago, I’d have bet this was more political rally talk than a real piece of legislation. But Congress actually passed it, and it’s… big. And kind of beautiful, depending on who you…

Read MoreW-2 vs. 1099 for Doctors: Which Saves More on Taxes?

Not all income is treated the same—especially when you’re a physician. Whether you’re working as a full-time W-2 employee or contracting as a 1099 independent doctor, how you’re classified can make a real difference on your taxes, deductions, and long-term financial strategy. Let’s walk through what each option really means, what it costs you, and…

Read MoreMid-Year Tax Planning Checklist for Busy Professionals

By the time June rolls around, most people stop thinking about taxes. But that’s usually when things start slipping through the cracks. If you’re a busy professional, you already know how quickly the year can get away from you. And when it comes to tax planning, waiting until December—or worse, April—isn’t exactly a winning strategy.…

Read MoreBuild Wealth Without the Tax Hit: 10 Investment Picks

Want to grow your money without handing a big chunk to the IRS every year?Smart investing isn’t just about returns. It’s about what you keep after taxes. Here are 10 investment picks and strategies that help you build wealth tax-free or tax-deferred, backed by real tax planning and proven results. We’ll also show you where…

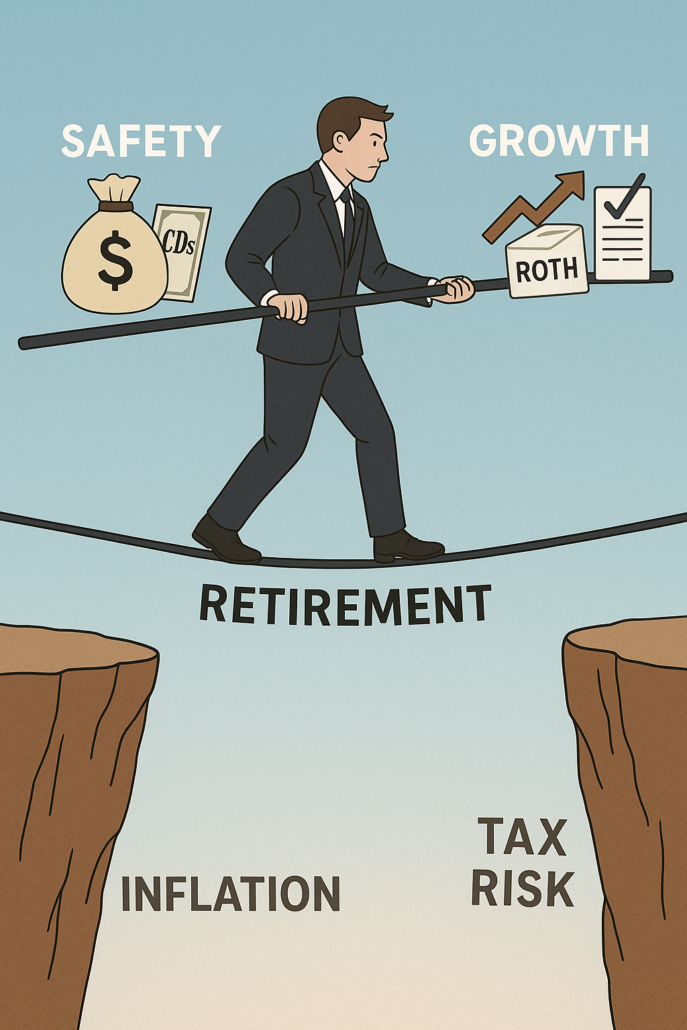

Read More4 Signs You’re Playing It Too Safe with Your Retirement

Playing it safe in retirement planning sounds wise. But being too cautious can quietly erode your wealth. Many investors, especially high-income professionals, overcorrect for risk—only to find themselves underprepared for rising costs, inflation, and tax burdens. If you’re too focused on protecting what you have, you might be missing out on sustainable growth, efficient tax…

Read MoreHigh State Income Taxes: How to Plan Smarter and Retire Wealthier

Understanding Why Some States Have Higher Income Taxes You might wonder why income taxes vary so much from state to state. The answer usually lies in how states balance their budgets. Some states, like California and New York, fund extensive public services with higher income taxes. Others, like Texas or Florida, skip income taxes but…

Read MoreDon’t Fear Market Losses—Learn from Them

Market losses are part of investing. They’re frustrating—but also useful. Every investor experiences them. What matters is how you respond. Don’t freeze. Reflect. Seeing your portfolio drop can lead to panic. But reacting emotionally often makes things worse. Ask yourself: Was your risk tolerance overestimated? Did you follow a plan—or invest based on hype? Is…

Read MoreHow Physicians Are Boosting Their Income Outside of Medicine

You worked hard for your medical degree. But more physicians are realizing that relying solely on clinical income may not be the most sustainable long-term path. You don’t have to trade all your time for money. Let’s look at how physicians across the country are building wealth outside the exam room—without giving up their identity…

Read More