Build Wealth Without the Tax Hit: 10 Investment Picks

Want to grow your money without handing a big chunk to the IRS every year?

Smart investing isn’t just about returns. It’s about what you keep after taxes.

Here are 10 investment picks and strategies that help you build wealth tax-free or tax-deferred, backed by real tax planning and proven results. We’ll also show you where a good tax advisor fits into all of this.

1. Roth IRA: Grow Tax-Free for Life

A Roth IRA gives you one of the best deals in the tax code. You contribute after-tax dollars, and your money grows tax-free. Withdrawals are also tax-free in retirement.

Why it works:

-

No tax on investment growth

-

No tax on qualified withdrawals

-

No required minimum distributions (RMDs)

When it’s best:

If you’re in a lower tax bracket now than you expect to be in retirement, a Roth IRA is a smart move.

Compare Roth and Traditional IRA here →

Want to learn how required withdrawals affect you? Read this guide on RMDs.

2. Health Savings Account (HSA): Triple Tax Savings

An HSA is the only account with three levels of tax savings:

-

Contributions are tax-deductible

-

Growth is tax-free

-

Withdrawals are tax-free when used for medical expenses

You can also invest your HSA funds for long-term growth, turning it into a stealth retirement account.

Contribution limits (2025):

-

$4,150 for individuals

-

$8,300 for families

-

$1,000 extra if you’re 55 or older

3. 401(k) and 403(b): Tax-Deferred Growth

These workplace retirement plans allow pretax contributions, reducing your taxable income now and delaying taxes until retirement.

Why they’re powerful:

-

High annual contribution limits ($23,000 for 2025, plus $7,500 catch-up if 50+)

-

Many employers offer a match

-

Investment growth isn’t taxed until you withdraw

Using a Mega Backdoor Roth strategy? That lets you supercharge after-tax savings inside a 401(k).

Learn more about that here.

4. 529 Plan: Education Savings with Tax-Free Growth

Saving for your child’s college? A 529 plan gives you:

-

Tax-free growth

-

Tax-free withdrawals for qualified education expenses

-

Some states also offer tax deductions for contributions

You can even use up to $10,000 per year for K–12 tuition and roll up to $35,000 into a Roth IRA for your child (new rule from SECURE Act 2.0).

Want to reduce taxes while planning for your child’s future? This article on physician side businesses shows how doctors are doing both.

5. Tax-Efficient Index Funds

Actively managed mutual funds churn your portfolio and trigger capital gains taxes every year.

Index funds minimize trading and delay most taxes until you sell. That’s a big deal over time.

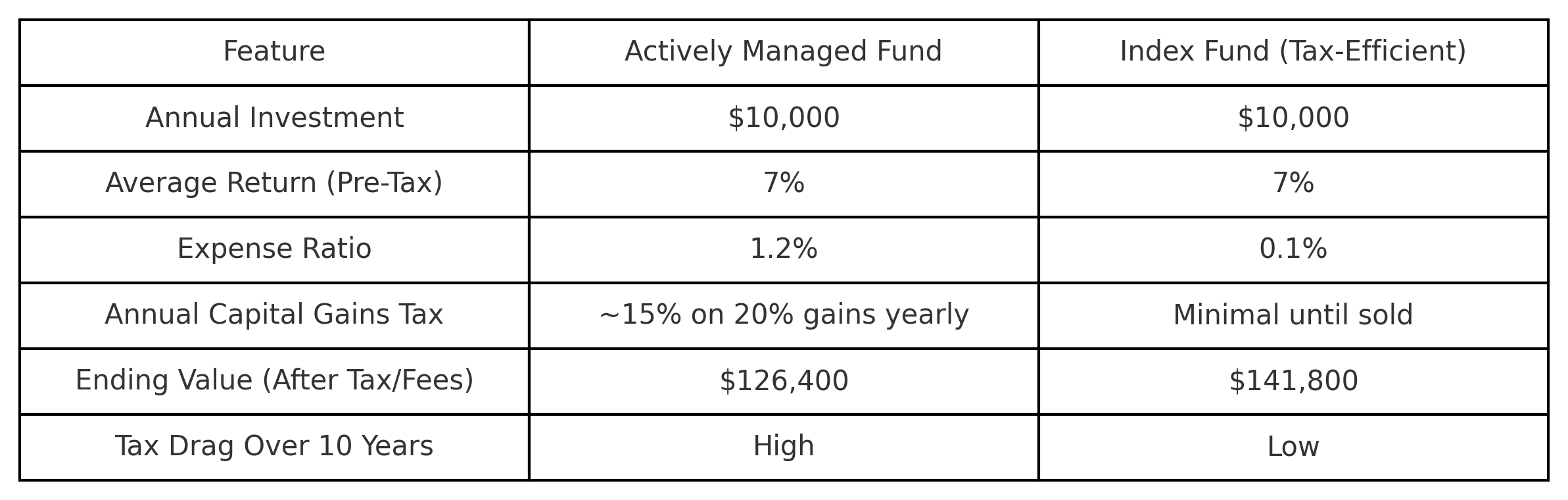

Example: $10K/year invested for 10 years on a $100K income

10-year comparison of returns: Index funds outperform actively managed funds by over $15,000 due to lower fees and better tax efficiency.

Key Insights:

-

The index fund investor keeps $15,400 more over 10 years

-

Lower fees and tax deferral drive better results

-

You reduce taxable events just by picking better vehicles

Want to avoid paying capital gains each year? Index funds help you do that.

Also: Read how market losses open up tax-saving opportunities

6. Municipal Bonds: Tax-Free Income

Municipal bonds (“munis”) are issued by state or local governments. The interest is exempt from federal income tax, and often from state tax too if you live in the issuing state.

Best for:

-

High-income earners in high-tax states

-

Conservative investors looking for steady income

IRS guide on municipal bond tax rules →

Planning for retirement in a high-tax state? Check this guide.

7. Real Estate with Strategic Deductions

Rental real estate offers:

-

Depreciation deductions

-

1031 exchanges to defer capital gains

-

Pass-through income with potential QBI deduction

Pair this with the right structure — like an S corporation or LLC — and you can unlock significant tax savings.

Explore more in this article: Best Tax Structure for Doctors

Or see how to lower taxes when selling a practice.

8. Tax-Loss Harvesting: Turn Losses into Savings

When your investments lose value, you can sell them and use the loss to offset:

-

Capital gains

-

Up to $3,000 of ordinary income per year

You can reinvest in similar assets to maintain your strategy without triggering the wash-sale rule.

This works especially well for physicians with 1099 income or other variable earnings.

See how here: 1099 Contractor Tax Guide

“now where did I plant those tech stocks?”

9. Backdoor Roth IRA: Bypass the Income Limits

High earners are often blocked from Roth IRA contributions. But the backdoor Roth strategy solves that:

-

Contribute to a traditional IRA (nondeductible)

-

Convert to a Roth IRA

This works best when:

-

You don’t already have a large traditional IRA

-

You plan carefully to avoid a big tax bill during conversion

Have multiple income streams? Read how to plan smarter

10. Work With a Tax Advisor

A good tax advisor:

-

Builds a personalized tax map around your goals

-

Reviews all your income sources for tax efficiency

-

Coordinates business structure, investments, and retirement strategy

Your tax situation is not one-size-fits-all.

The best tax advisors go beyond filing. They help you make smart investment moves all year.

You don’t have to do this alone — learn more about saving money without cutting back.

Key Takeaways

You can build real wealth — without giving it all away in taxes — by focusing on:

-

Tax-deferred and tax-free accounts

-

Tax-efficient investments

-

Strategic deductions and structures

-

Professional guidance

These 10 picks help you keep more of what you earn and grow it with purpose.

FAQ

Q: What’s the most tax-efficient investment account?

A: For long-term growth, a Roth IRA or HSA offers the best tax treatment — both can grow and distribute funds tax-free.

Q: Can I avoid paying taxes every year on my investments?

A: Yes. By using retirement accounts, municipal bonds, index funds, and tax-loss harvesting, you can reduce or defer most tax exposure.

Q: Are municipal bonds a good fit for me?

A: If you’re in a high tax bracket, municipal bonds can provide tax-free income. They’re especially useful for conservative investors in high-tax states.

Q: Should I hire a tax advisor to help with my investments?

A: If you have multiple income streams, own a business, or earn 1099 income, working with a tax advisor can help you avoid costly mistakes.

Q: What’s the best way to save for my child’s education and still reduce taxes?

A: A 529 plan is the go-to option. It offers tax-free growth and withdrawals for qualified education expenses.

Visit contact physiciantaxsolutions.com to schedule a consultation and learn how we can help you take control of your tax strategy today.

This post serves solely for informational purposes and should not be construed as legal, business, or tax advice. Individuals should seek guidance from their attorney, business advisor, or tax advisor regarding the matters discussed herein. physiciantaxsolutions.com assumes no responsibility for actions taken based on the information provided in this post.