Posts Tagged ‘retirement planning’

Make Your Retirement Plan Pay You Back

You work hard.Your retirement plan should pay you back now and later. This guide gives you clear steps you can run this month.Short lines. Direct actions. No fluff. What “pay you back” means Cash benefit today Lower taxes this year Flexible withdrawals later Protection for family and practice Ask yourself: Where’s the free money? Which…

Read MoreMake Your Retirement Plan Pay You Back

You work hard.Your retirement plan should pay you back—now and later. This guide shows simple moves you can run this month.Short lines. Clear actions. No fluff. What “pay you back” means Cash benefit today Lower taxes this year More choices later Protection for your family and practice Ask yourself: Where can I get free money?…

Read MoreMid-Year Tax Planning Checklist for Busy Professionals

By the time June rolls around, most people stop thinking about taxes. But that’s usually when things start slipping through the cracks. If you’re a busy professional, you already know how quickly the year can get away from you. And when it comes to tax planning, waiting until December—or worse, April—isn’t exactly a winning strategy.…

Read MoreManaging Your Finances Despite Trump Tariffs

The impact of tariffs, particularly those implemented during the Trump administration, has been felt by businesses and individuals alike. Whether you’re a business owner, an investor, or a consumer, these tariffs can affect everything from product prices to investment strategies. This blog will walk you through how to manage your finances during this turbulent time,…

Read MoreCelebrating Memorial Day with a Roth Conversion? Here’s When It Makes Sense

Memorial Day marks more than just the start of summer. It’s also a smart checkpoint in the year to revisit your finances — especially your retirement strategy. One question you might be asking:Should I do a Roth conversion now? The answer depends on timing, income, tax projections, and your long-term goals. What Is a Roth…

Read MoreStrategies to Reduce Your Tax Liability

Taxes can feel like a heavy burden, but there are many ways you can reduce your tax liability if you take the right steps. Whether you’re a business owner, a high-income earner, or just someone looking to make the most of your finances, understanding tax-saving strategies is crucial. In this guide, we’ll break down the…

Read MoreWhen Does a Roth Conversion Make Financial Sense?

A Roth conversion lets you shift money from a pre-tax retirement account into a Roth IRA. The trade-off: you pay taxes now in exchange for tax-free withdrawals later. Done strategically, a Roth conversion can lower your lifetime tax bill, reduce required minimum distributions (RMDs), and give you more control over retirement income. But the benefits…

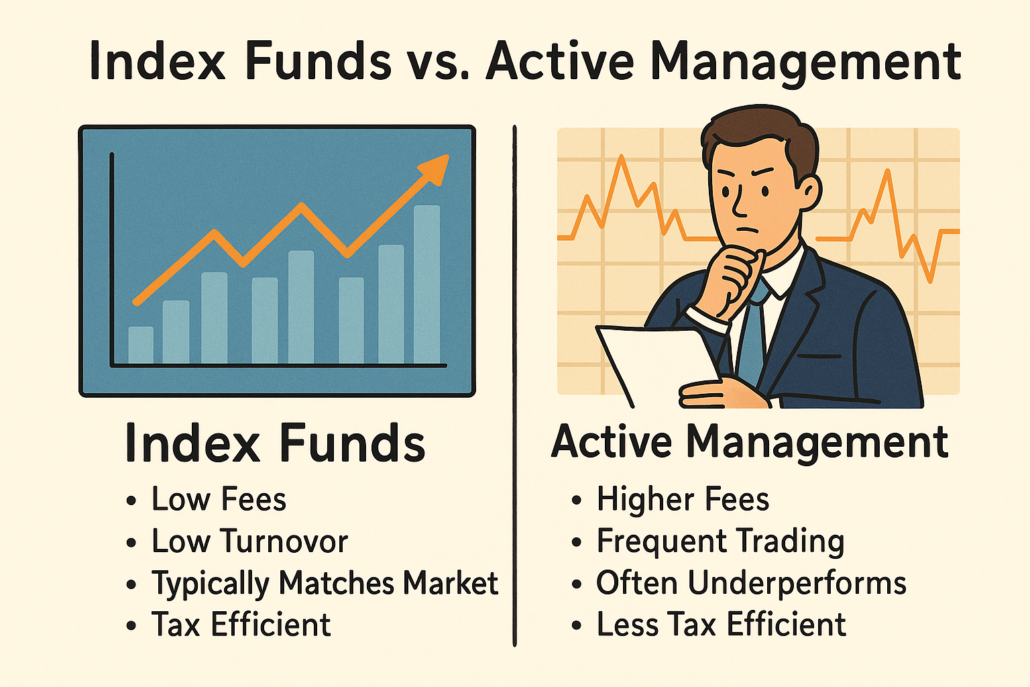

Read MoreIndex Funds vs. Active Management: What Really Wins

If you want to grow your wealth without unnecessary risk or tax drag, your investment strategy matters. For high-income professionals, especially physicians, choosing between index funds and active management isn’t just about returns — it’s about efficiency, control, and long-term outcomes. So, what actually wins in the long run? Let’s break it down. What’s the…

Read More10 Investor Mindset Shifts to Handle Market Losses

Market downturns test even the most disciplined investors. When portfolios shrink, fear takes over. But emotional investing mistakes rarely lead to long-term success. The right investor mindset during a market crash helps you stay focused, minimize losses, and even uncover new opportunities. Here are 10 shifts you can make to keep your investment strategy on…

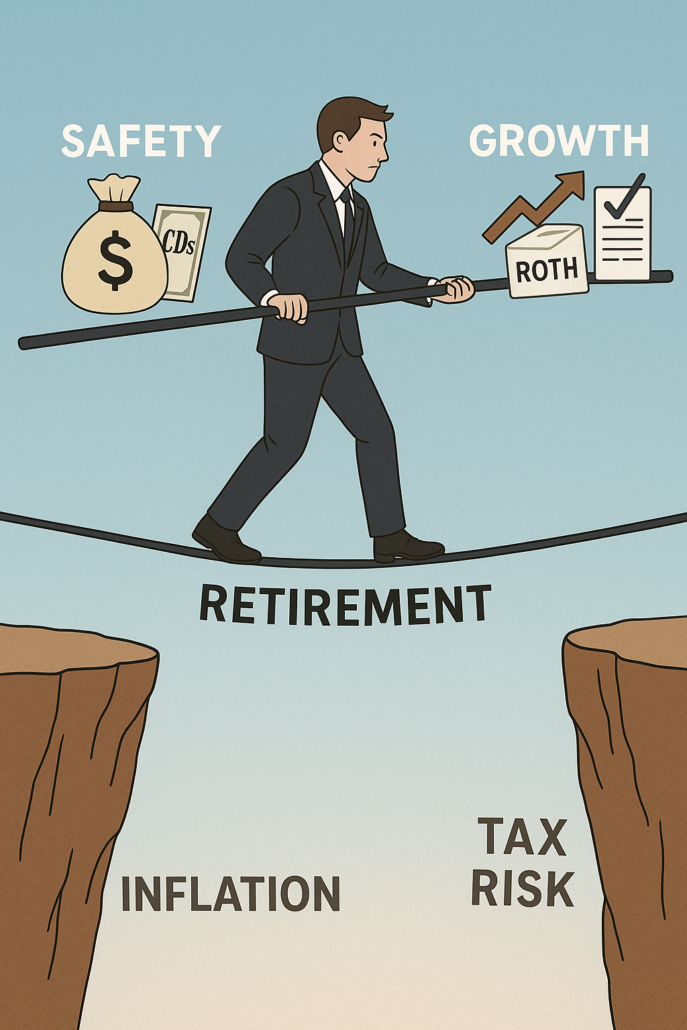

Read More4 Signs You’re Playing It Too Safe with Your Retirement

Playing it safe in retirement planning sounds wise. But being too cautious can quietly erode your wealth. Many investors, especially high-income professionals, overcorrect for risk—only to find themselves underprepared for rising costs, inflation, and tax burdens. If you’re too focused on protecting what you have, you might be missing out on sustainable growth, efficient tax…

Read More