High-Income Earners: Should You Use a Deferred Compensation Plan?

If you’re a high-income professional—particularly a physician—you may be looking for ways to reduce your tax burden while building long-term wealth. One overlooked tool that can help is the deferred compensation plan. But is it the right move for you? Let’s explore how these plans work, how they benefit high earners like doctors and executives,…

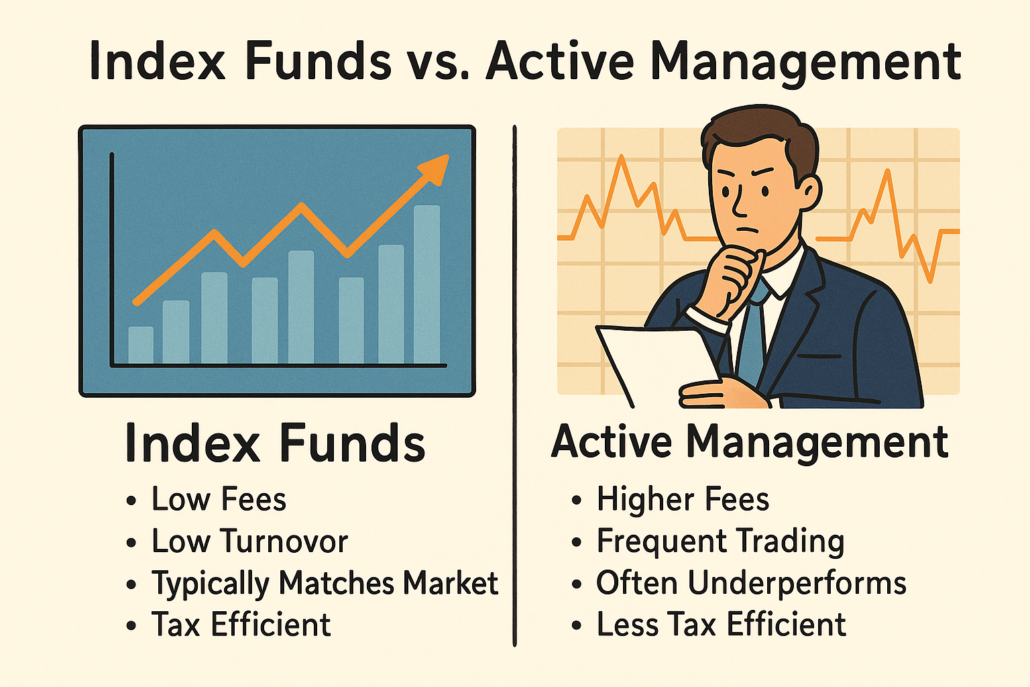

Read MoreIndex Funds vs. Active Management: What Really Wins

If you want to grow your wealth without unnecessary risk or tax drag, your investment strategy matters. For high-income professionals, especially physicians, choosing between index funds and active management isn’t just about returns — it’s about efficiency, control, and long-term outcomes. So, what actually wins in the long run? Let’s break it down. What’s the…

Read MoreBuild Wealth Without the Tax Hit: 10 Investment Picks

Want to grow your money without handing a big chunk to the IRS every year?Smart investing isn’t just about returns. It’s about what you keep after taxes. Here are 10 investment picks and strategies that help you build wealth tax-free or tax-deferred, backed by real tax planning and proven results. We’ll also show you where…

Read More10 Investor Mindset Shifts to Handle Market Losses

Market downturns test even the most disciplined investors. When portfolios shrink, fear takes over. But emotional investing mistakes rarely lead to long-term success. The right investor mindset during a market crash helps you stay focused, minimize losses, and even uncover new opportunities. Here are 10 shifts you can make to keep your investment strategy on…

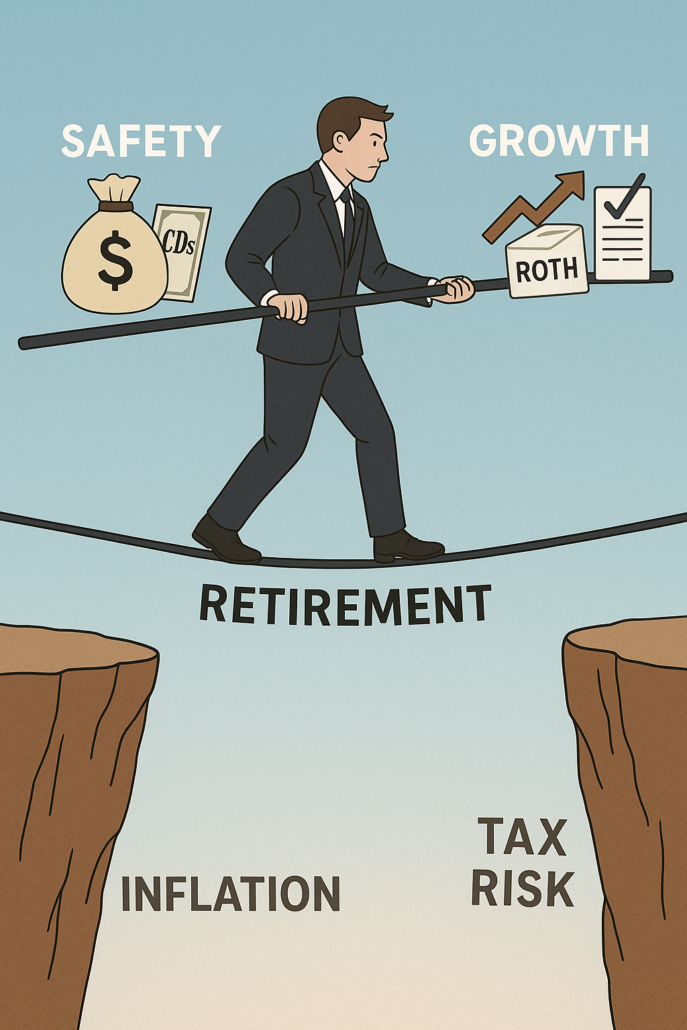

Read More4 Signs You’re Playing It Too Safe with Your Retirement

Playing it safe in retirement planning sounds wise. But being too cautious can quietly erode your wealth. Many investors, especially high-income professionals, overcorrect for risk—only to find themselves underprepared for rising costs, inflation, and tax burdens. If you’re too focused on protecting what you have, you might be missing out on sustainable growth, efficient tax…

Read MoreThe Worst Ways to Invest in Real Estate

Real Estate Isn’t Always a Goldmine Some of the worst ways to invest in real estate are disguised as smart financial moves. While property investing is often praised for its wealth-building potential, not all deals pay off. In fact, many real estate ventures drain your money, time, and tax efficiency—especially when they’re driven by hype…

Read MoreDon’t Buy Stuff You Can’t Afford

A Tax-Smart Path to Financial Control and Retirement Freedom Living beyond your means doesn’t just lead to stress and debt. It’s one of the clearest examples of how overspending hurts your taxes and retirement. When your money goes toward short-term indulgences instead of strategic planning, you lose out on valuable tax benefits and delay your…

Read MoreHigh State Income Taxes: How to Plan Smarter and Retire Wealthier

Understanding Why Some States Have Higher Income Taxes You might wonder why income taxes vary so much from state to state. The answer usually lies in how states balance their budgets. Some states, like California and New York, fund extensive public services with higher income taxes. Others, like Texas or Florida, skip income taxes but…

Read MoreHow to Save More Without Sacrificing Enjoyment

Saving money should not feel like punishment. You deserve to enjoy your life today while building financial security for the future. With the right strategies, you can save more without cutting out what makes life meaningful. Here’s how you can make smart financial moves — and still have fun along the way. How to Save…

Read MoreReduce Home Insurance Premiums Without Compromising Protection

Home insurance protects your biggest investment—your home. But that doesn’t mean you need to overpay for it. Here’s how you can lower your premiums while keeping solid coverage in place. Raise Your Deductible A higher deductible usually means lower monthly premiums. Consider increasing your deductible to $1,000 or more Make sure you have enough saved…

Read More