Physicians’ Guide to Estimated Tax Penalties

As a physician, you know the United States operates on a “pay as you go” tax system. This means you must make income tax payments to the IRS throughout the year as you earn income, whether through withholding, estimated tax payments, or both. If you underpay your taxes during the year, the IRS assesses estimated tax penalties. These penalties, also known as the “underpayment penalty,” are calculated quarterly based on the amount of unpaid tax for that quarter. The penalty equals the federal short-term interest rate plus 3 percent.

This rate changes based on general interest rates, so the penalty amount fluctuates accordingly. Recently, due to a rapid rise in interest rates, the penalty has surged to a whopping 8 percent from October 1, 2023, through March 31, 2024—the highest since 2007. It’s important to note that this penalty is not deductible, making your effective penalty rate much higher than 8 percent.

Given this high penalty rate, avoiding it by paying enough tax during the year is crucial. While you can seek a penalty waiver from the IRS, it’s likely not available to you except in limited circumstances. Unfortunately, no such penalty relief is available for corporations.

Estimated Taxes for Individuals

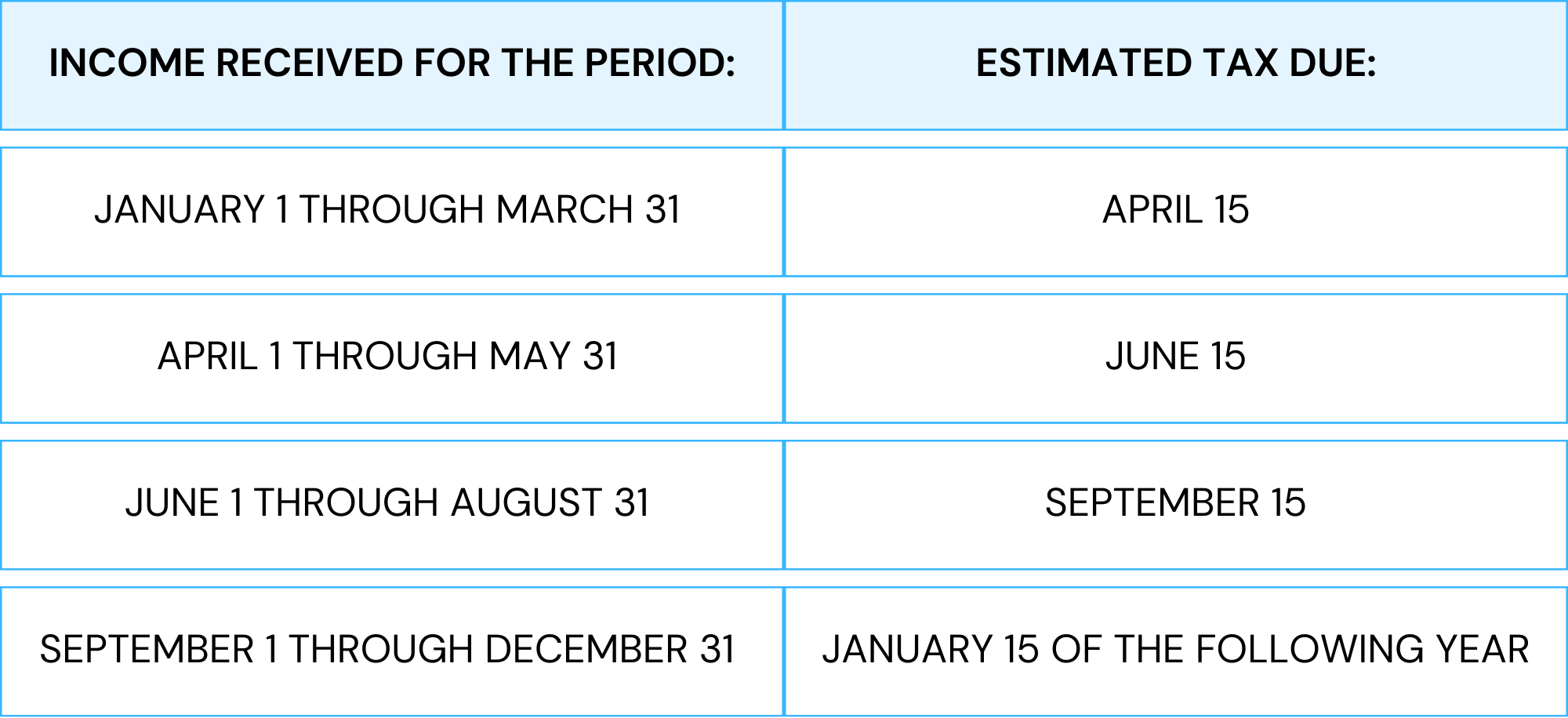

You need to ensure you’re meeting your tax obligations to avoid underpayment penalties. You’re required to pay 25 percent of your “required annual payment” to the IRS by specific dates throughout the year: April 15, June 15, September 15, and January 15. This required payment is determined as the smaller of 90 percent of the total tax due for the current year or 100 percent of the total tax paid the previous year. For higher-income taxpayers with adjusted gross incomes exceeding $150,000 ($75,000 for married couples filing separately), it’s 110 percent of the previous year’s tax. Your prior-year tax return usually contains a schedule of estimated tax payments for the following tax year and payment vouchers.

If you primarily earn income through employee wages, your employer usually takes care of this through withholding from your paychecks. However, if you receive substantial income without tax withheld—such as dividends, interest, contract pay, or capital gains—you may need to pay estimated tax. Alternatively, you can adjust your employee withholding to meet the required annual payment.

For those receiving taxable retirement account distributions, you have the option to have tax withheld, pay estimated tax, or both.

But if you’re self-employed—whether as a sole proprietor, partner in a partnership, or member of a limited liability company—no tax is withheld from your business income. In such cases, you must pay quarterly estimated taxes throughout the year.

Additionally, LLC members and partners in partnerships are required to pay individual estimated tax on their share of the partnership or LLC income, regardless of whether they receive distributions. However, there’s a threshold: if you owe less than $1,000 in federal tax for the year—including income tax and self-employment taxes—you don’t need to pay estimated tax.

How Much to Pay

You have two options to avoid estimated tax penalties:

- Pay either 100 or 110 percent of your prior year’s tax, depending on your income, or

- Pay 90 percent of the tax due for the current year.

It’s also important to note that while a tax return extension provides breathing room for completing and submitting your tax paperwork, it does not extend the deadline for paying your taxes. It’s essential to estimate and pay any owed taxes by your original deadline (Usually April 15th) to avoid penalties, interest charges, and compliance issues. By staying proactive and making timely estimated tax payments, you can maintain financial stability, comply with tax laws, and enjoy peace of mind throughout the year.

Estimated Tax Penalty

If you fail to make the required payments, the IRS automatically assesses estimated tax penalties. These penalties are not tax-deductible and are added on top of your tax.

Here’s the kicker: since the penalties aren’t deductible, you’re paying them with after-tax dollars. For instance, if your combined income and self-employment tax rate is 40 percent, an 8 percent non-deductible penalty equates to 13.3 percent interest (8 percent ÷ 0.6 percent after-tax rate).

The penalty is calculated separately for each payment period. So, increasing your estimated tax payments for a later period won’t reduce the penalty for a previous period, even if you’re expecting a refund when you file your tax return.

However, there’s a loophole: you can avoid the estimated tax penalty for the fourth quarter by filing your tax return and paying all your tax due by January 31.

You have two options for calculating the penalty: you can either complete IRS Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, and pay it with your return, or let the IRS calculate the penalty and bill you for it.

Estimated Tax Penalty Waivers

You may encounter situations where you or your patients face IRS penalties. Unlike with most other IRS penalties, the estimated tax penalty won’t be waived on grounds of reasonable cause. This means that even if you or a family member experiences serious illness or injury, or a similar uncontrollable circumstance, the penalty may still apply. Additionally, the first-time abatement penalty waiver cannot be used to waive this penalty. The IRS can only waive the estimated tax penalty in very specific and limited circumstances.

Casualty or Disaster

You may find relief in knowing that the IRS has provisions to waive all or part of the penalty in certain situations. If imposing the penalty is deemed inequitable due to circumstances like a casualty, disaster, or other unusual events, you may be eligible for this waiver.

Moreover, if you reside in a federally declared disaster area, you automatically receive additional time to pay your estimated taxes. You don’t need to wait for your home or office to be damaged to qualify for this extension. The IRS identifies taxpayers in covered disaster areas based on county or parish and applies the appropriate penalty relief accordingly. In such cases, there’s no need to file Form 2210 to request a waiver.

Estimated Taxes for Corporations

You may need to understand the requirements for making quarterly estimated tax payments for different types of corporations.

C-corporations are required to make quarterly estimated tax payments if they anticipate owing $500 or more in taxes when they file their return. These payments are calculated using Form 1120-W, Estimated Tax for Corporations. For calendar-year corporations, payments are due on April 15, June 15, September 15, and December 15. For those using a fiscal year, payments are due on the 15th day of the fourth, sixth, ninth, and 12th months of their fiscal year.

On the other hand, S corporations typically do not make estimated tax payments, except in certain cases. If an S corporation owes $500 or more in taxes on built-in gains, excess net passive income, or investment credit recapture, then it must make estimated tax payments. Shareholders of S corporations are responsible for paying individual estimated taxes based on their share of the corporation’s income, as S corporation income or loss is considered to pass through to shareholders daily.

Like individuals, corporations must make estimated tax payments to avoid penalties, which are not tax-deductible and are in addition to tax liabilities. The required annual payment for corporations is the lesser of 100 percent of the tax shown on the current year’s return or 100 percent of the tax shown on the preceding year’s return.

However, so-called large corporations cannot base their required annual payment on the preceding year’s tax if they meet certain criteria. Large corporations are defined as those with at least $1 million in taxable income for any of the three preceding tax years.

Corporations have four methods available to calculate estimated tax payments and avoid underpayment penalties:

- Current-year method: Make four quarterly payments, each equal to 25 percent of the income tax expected to be shown on the return for the year.

- Preceding-year method: Make four quarterly payments equal to 25 percent of the tax shown on the return for the preceding tax year, with certain conditions.

- Annualized income method: Pay estimated taxes based on actual income earned during each quarter.

- Adjusted seasonal income method: Annualize income based on recurring seasonal patterns of taxable income.

Understanding these requirements can help ensure compliance with IRS regulations and avoid underpayment penalties. As a physician, it’s crucial to understand the implications of underpaying estimated taxes for corporations.

If a corporation pays insufficient estimated tax, it will incur the estimated tax penalty, which is calculated separately for each installment due date. This means that even if the corporation pays enough tax later to cover the underpayment, it may still owe a penalty for earlier due dates.

The penalty amount follows the same formula as for individuals: the federal short-term rate plus three percentage points. However, if a corporation’s underpayment exceeds $100,000 for any taxable period, the penalty rate increases by two percentage points, totaling the short-term federal rate plus five percentage points. Interest begins accruing at this higher rate on the entire underpayment amount (tax, penalty, and interest) 30 days after receiving a 30-day letter or a notice of deficiency.

Unlike individuals, corporations do not have a reasonable cause exception to avoid the penalty for underpayment of estimated tax. Furthermore, the IRS does not grant waivers of the penalty to corporations under any circumstances. Understanding these rules is essential for ensuring compliance and avoiding penalties.

Don’t Let Tax Complexity Hold You Back – Get in Touch!

In navigating the complexities of estimated tax obligations as a physician, staying informed and proactive is key to avoiding penalties and maintaining financial stability. Whether you’re managing individual or corporate tax responsibilities, understanding the rules and meeting obligations is crucial. At Physician Tax Solutions, we specialize in assisting healthcare professionals like you with tax planning, compliance, and penalty mitigation. Contact us today to learn more about how we can tailor our services to your specific needs and help you navigate the intricate landscape of tax regulations. Don’t let tax complexities impede your focus on patient care – reach out to us for expert assistance.

Takeaways

Here are five takeaways from this article:

- Pay As You Go System: Physicians, like all taxpayers in the US, are subject to a “pay as you go” tax system. This means making income tax payments to the IRS throughout the year, either through withholding or estimated tax payments. Failure to meet these obligations can lead to underpayment penalties.

- Quarterly Assessment: Estimated tax penalties, also known as underpayment penalties, are calculated quarterly based on the amount of unpaid tax for that quarter. The penalty rate, which includes the federal short-term interest rate plus 3 percent, can fluctuate based on general interest rates.

- Individual and Corporate Obligations: Individuals, including self-employed physicians, need to pay 25 percent of their required annual payment to the IRS by specific dates throughout the year. This payment is based on either 90 or 100 percent of the total tax due for the current year or the previous year’s tax, depending on income levels.

- Avoiding Penalties: To avoid estimated tax penalties, taxpayers have two options: paying either 100 or 110 percent of the prior year’s tax or 90 percent of the tax due for the current year. It’s crucial to make these payments on time to prevent penalties, interest charges, and compliance issues.

- Penalty Waivers and Exceptions: While some penalty waivers are available in specific circumstances, such as casualties or disasters, the IRS does not grant waivers of the estimated tax penalty to corporations under any circumstances. Understanding the rules and meeting obligations is vital for compliance and penalty avoidance.