Guide to Itemized Deductions: Your Better Tax Plan

Itemized Deductions serve as a crucial tool in navigating the complexities of modern tax obligations, especially for high-income professionals like yourself. Amidst the hustle and bustle of contemporary life, you find yourself grappling with mounting tax burdens, and underscoring the pressing need to optimize your financial health. Through the strategic utilization of itemized deductions, you can substantially alleviate your tax liabilities and assert greater control over your financial future. This guide is dedicated to demystifying the realm of itemized deductions, providing invaluable insights to facilitate informed and strategic tax decisions tailored to your needs.

Understanding the Basics of Itemized Deductions

Let’s delve into the nitty-gritty of itemized deductions, shall we? They are not as daunting as they may seem. Imagine them as minuses you can make from your adjusted gross income (AGI), the all-important figure that determines your tax bracket. They encapsulate a wide spectrum of expenses – think medical and dental costs, state and local taxes, interest on your home mortgage, and even charitable contributions. It’s like claiming back some of the money you’ve already spent. The magic lies in how these deductions can shrink your taxable income, and with it, your tax bill. However, choosing to itemize is not a decision to be made lightly. It involves a comparison with the standard deduction, weighing one against the other to see which one offers the maximum benefit for your specific situation. It’s a bit like choosing between two roads, both leading to the same destination – reduced taxes – but each offering a different journey. So, let’s set off on this tax planning journey together, unlocking the potential of itemized deductions to enhance your financial health.

Itemized Deductions vs. Standard Deductions

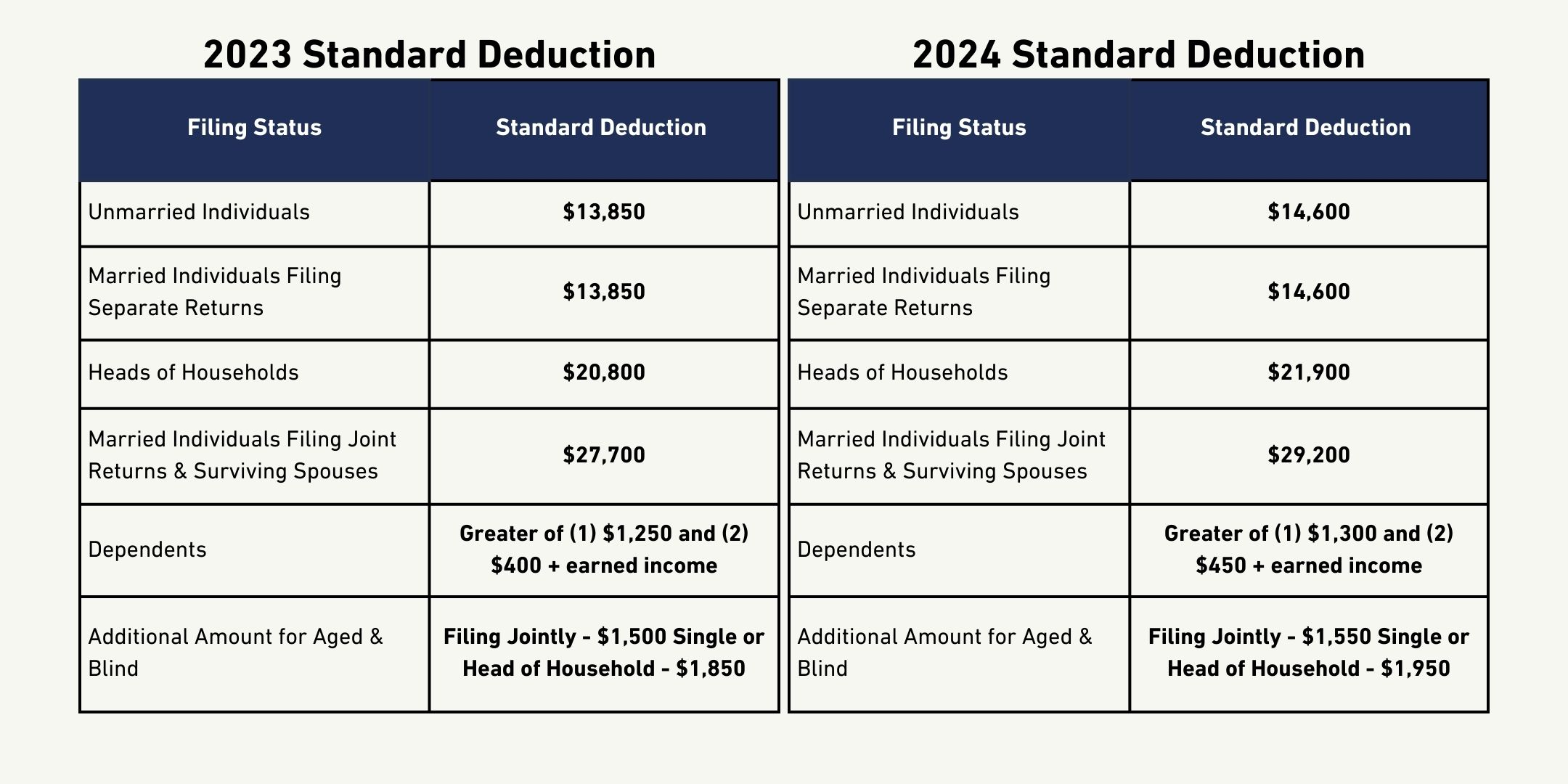

Think of the standard deduction as a one-size-fits-all tax reduction. It’s a preset, static figure that you can subtract from your taxable income, regardless of your spending or lifestyle. Now, envision itemized deductions as a tailor-made suit, precisely cut to fit your unique financial patterns. These deductions encapsulate various qualifying expenses you’ve racked up throughout the year. It’s a more meticulous process but potentially more rewarding.

Here’s the catch though – you can’t have your cake and eat it too. You must choose between the standard and itemized deductions each tax year. It’s a bit like standing at a fork in the road, map in hand, deciding which route will take you to your destination – a smaller tax bill – more efficiently.

But how do you choose? It’s simple. Break out your calculator, roll up your sleeves, and crunch the numbers. Compare the standard deduction to the total of your potential itemized deductions. Whichever figure is higher, that’s your ticket to tax savings. Making this calculation is crucial to ensure you’re not leaving any tax-saving opportunities on the table. Remember, every dollar saved is a dollar earned. Now, isn’t that a thought worth pondering?

The Intricacies of Medical and Dental Expenses

Navigating through the complex world of medical and dental expenses as itemized deductions can feel like walking through a maze. However, with a little guidance, you can turn this into a rewarding journey towards tax reduction. Here’s the thing – while these expenses are deductible, there’s a catch. The IRS stipulates that you can only subtract the portion of your total unreimbursed medical and dental costs that exceeds 7.5% of your AGI. So, if you’re earning a handsome sum of $100,000, only expenses over $7,500 are eligible for deductions.

This might sound a tad complicated, but it’s a crucial detail in your roadmap to tax savings. Knowledge is power, and understanding these subtle nuances can make a big difference to your final tax bill. So, don’t just skim over your receipts, dive deep into the details. Keep a keen eye on those medical and dental costs. They could hold the key to a chunky tax deduction that’s waiting to be unlocked. Remember, in the realm of taxes, every detail counts. It’s all about playing the game strategically, and medical and dental expenses are a piece of the tax-saving puzzle you wouldn’t want to overlook. It’s time to embrace these intricacies, turn them to your advantage, and journey closer to your ultimate destination – a significantly reduced tax bill.

Maximizing Deductions Through Charitable Contributions

Harnessing the power of generosity for tax benefits is an oft-underestimated strategy. But with the right knowledge, your acts of kindness can also serve as a springboard to leap towards significant tax savings. Let’s explore how.

Making a charitable donation? Brilliant! You’re not just making a difference to a worthy cause, but you’re also carving out a potential path to reduce your tax burden. The IRS allows deductions for such contributions to qualified organizations. However, it’s not merely about writing a check or transferring funds. It’s also about being meticulous in record-keeping, maintaining a trail of all donations. Should an IRS audit come knocking, you’ll need to provide evidence of your charitable actions.

But there’s a caveat. There are ceilings to consider. Typically, you can deduct up to 60% of your AGI in charitable contributions. However, variations can occur, influenced by factors such as the type of organization you’re donating to and the nature of your gift.

Unlocking the power of charitable contributions as tax deductions is a bit like conducting a symphony. Each detail, each nuance plays its part, creating a harmonious blend that could lead to a crescendo of tax savings. So, keep a keen eye on those charitable contributions. They might just be the notes you need to compose your melody of reduced taxes.

State and Local Taxes, and Mortgage Interest Deductions

Picture this: you’ve shelled out on state and local taxes, and you’re dutifully making your mortgage payments. You sigh, wondering if there’s a silver lining. Good news, there is! The tax world can be quite the maze, but it also holds hidden treasures. One such treasure is the ability to deduct state and local taxes (SALT), including property, income, and sales taxes, up to a limit of $10,000 (or $5,000 if you’re married filing separately). What’s more, you can also chip away at your tax burden by deducting the interest paid on your mortgage. This applies to the first $750,000 of your mortgage debt. Now, that’s what we call turning obligations into opportunities!

Especially if you’re living in high-tax states or servicing a sizeable mortgage, these deductions can put a significant dent in your tax bill. It’s like the tax code is throwing you a lifeline, and it’s up to you to grab it. So, roll up your sleeves, and let’s dig deeper into your state and local taxes and mortgage interest payments. There could be a goldmine of tax deductions waiting to be unearthed, serving as a beacon guiding you towards your financial goals.

Investment and Tax Planning for High-income Professionals

Itemized deductions are a key player in your game of tax reduction. Yet, they’re merely a part of your grander financial game plan. Venturing beyond this realm, you’ll discover tax-efficient investing strategies waiting to be discovered and harnessed. This includes contributing maximally to retirement accounts offering tax advantages, choosing investments with tax efficiency in mind, and strategically reducing or deferring capital gains. It’s like finding hidden gems in the labyrinth of tax planning.

Imagine tax planning as an intricate jigsaw puzzle, with itemized deductions being just one piece. Each strategy, each decision you make, fits together to form the big picture – a robust, comprehensive plan that paves the way towards achieving financial independence and accumulating wealth.

So, brace yourself to delve deeper into the world of strategic tax planning and investing. It’s time to don your financial explorer hat and venture beyond the borders of itemized deductions. Let’s unearth these hidden gems together, weave them into your financial strategy, and walk the path toward your ultimate destination: an optimized tax scenario and a robust financial future. Every step you take, and every strategy you implement, brings you closer to this goal. With knowledge as your compass and strategic planning as your map, let’s set sail on this exciting financial journey.

At Physician Tax Solutions, we prioritize your financial stability above all else. Our dedicated team is committed to guiding you through the intricacies of IRS protocols, ensuring your peace of mind. If you’re seeking tailored strategies to alleviate your tax responsibilities, we’re here to help. Reach out to us via our contact form to explore personalized tax planning solutions designed to lower your tax bill effectively.