Posts Tagged ‘tax planning’

Managing Your Finances Despite Trump Tariffs

The impact of tariffs, particularly those implemented during the Trump administration, has been felt by businesses and individuals alike. Whether you’re a business owner, an investor, or a consumer, these tariffs can affect everything from product prices to investment strategies. This blog will walk you through how to manage your finances during this turbulent time,…

Read MoreStrategies to Reduce Your Tax Liability

Taxes can feel like a heavy burden, but there are many ways you can reduce your tax liability if you take the right steps. Whether you’re a business owner, a high-income earner, or just someone looking to make the most of your finances, understanding tax-saving strategies is crucial. In this guide, we’ll break down the…

Read MoreHow to Evaluate a Rental Property: 5 Essential Rules

Investing in rental properties can be a lucrative venture if done correctly. However, to ensure your investment provides consistent returns, you need to evaluate potential properties carefully. The following five essential rules will help you make informed decisions, backed by practical and actionable insights. 1. Analyze the Location The location of a rental property is…

Read MoreThe 10 Biggest Pitfalls of Tax-Loss Harvesting

Tax-loss harvesting is a powerful tool for reducing tax liability, but like any strategy, it can go wrong if not executed properly. Understanding its pitfalls is crucial for investors who want to use this technique effectively. This post will explore the 10 biggest mistakes investors make with tax-loss harvesting, explain how tax advisors can help…

Read MoreWhen Does a Roth Conversion Make Financial Sense?

A Roth conversion lets you shift money from a pre-tax retirement account into a Roth IRA. The trade-off: you pay taxes now in exchange for tax-free withdrawals later. Done strategically, a Roth conversion can lower your lifetime tax bill, reduce required minimum distributions (RMDs), and give you more control over retirement income. But the benefits…

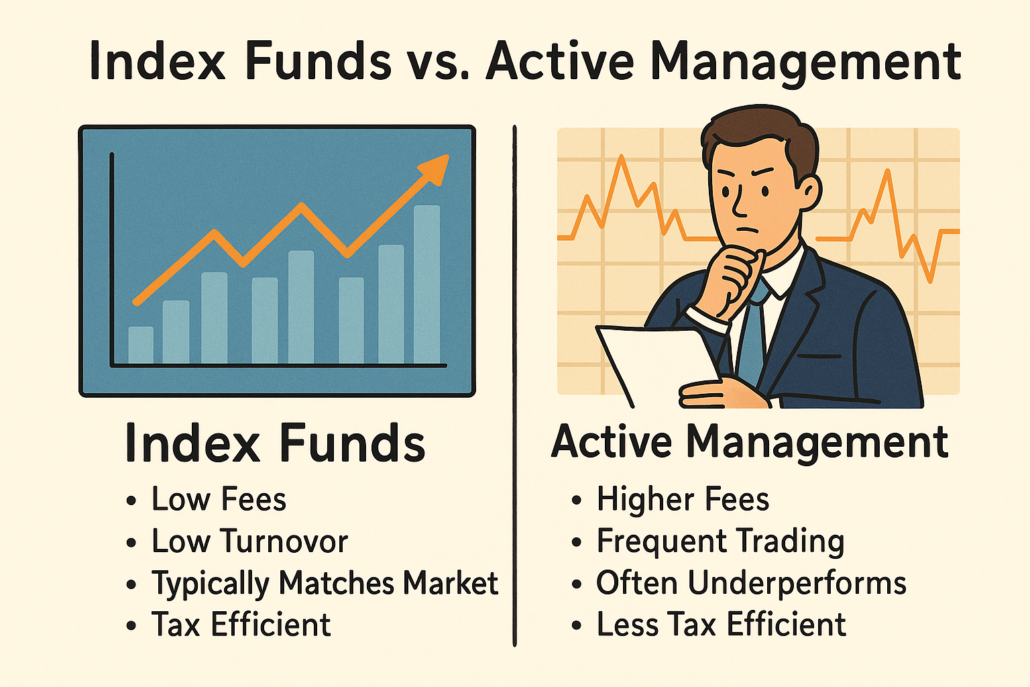

Read MoreIndex Funds vs. Active Management: What Really Wins

If you want to grow your wealth without unnecessary risk or tax drag, your investment strategy matters. For high-income professionals, especially physicians, choosing between index funds and active management isn’t just about returns — it’s about efficiency, control, and long-term outcomes. So, what actually wins in the long run? Let’s break it down. What’s the…

Read MoreThe Worst Ways to Invest in Real Estate

Real Estate Isn’t Always a Goldmine Some of the worst ways to invest in real estate are disguised as smart financial moves. While property investing is often praised for its wealth-building potential, not all deals pay off. In fact, many real estate ventures drain your money, time, and tax efficiency—especially when they’re driven by hype…

Read MoreDon’t Buy Stuff You Can’t Afford

A Tax-Smart Path to Financial Control and Retirement Freedom Living beyond your means doesn’t just lead to stress and debt. It’s one of the clearest examples of how overspending hurts your taxes and retirement. When your money goes toward short-term indulgences instead of strategic planning, you lose out on valuable tax benefits and delay your…

Read More1099 Contractors: Your Guide to Managing Income, Taxes, and Deductions

Knowing how 1099 contractors can manage taxes and maximize deductions is essential to keeping more of what you earn. As a contractor, you’re in control of your income—but also responsible for every tax detail. 1. Know What It Means to Be a 1099 Contractor You’re not an employee. You’re self-employed. That means: No tax is…

Read MoreDon’t Fear Market Losses—Learn from Them

Market losses are part of investing. They’re frustrating—but also useful. Every investor experiences them. What matters is how you respond. Don’t freeze. Reflect. Seeing your portfolio drop can lead to panic. But reacting emotionally often makes things worse. Ask yourself: Was your risk tolerance overestimated? Did you follow a plan—or invest based on hype? Is…

Read More