Posts Tagged ‘tax advisor help’

How Businesses—New and Old—Can Save More on Taxes

Every business—whether it’s been around for decades or just launched last month—has something in common: taxes. Taxes don’t care if you’re bootstrapping in year one or leading a multi-million-dollar operation. They show up every year, every quarter, without fail. And if you’re not intentional about managing them, they’ll quietly drain resources you could’ve put to…

Read MoreTop 5 Summer Tax Tips for Consultants and Coaches

Summer might not scream “tax planning,” but that doesn’t mean it’s a time to go quiet on your finances. If you’re a consultant or coach, this season offers a clean break from tax season chaos and a chance to get ahead of your 2025 tax bill. Think of it as a mid-year checkup before anything…

Read MoreMid-Year Checklist for 1099 Earners: Taxes, Deductions, and More

By the time June rolls around, most 1099 earners—freelancers, consultants, contractors—are already knee-deep in work. But what about taxes? The middle of the year is a critical checkpoint. It’s a moment to step back, evaluate, and adjust before things spiral toward year-end chaos. This checklist is for you if you’ve received non-W2 income and want…

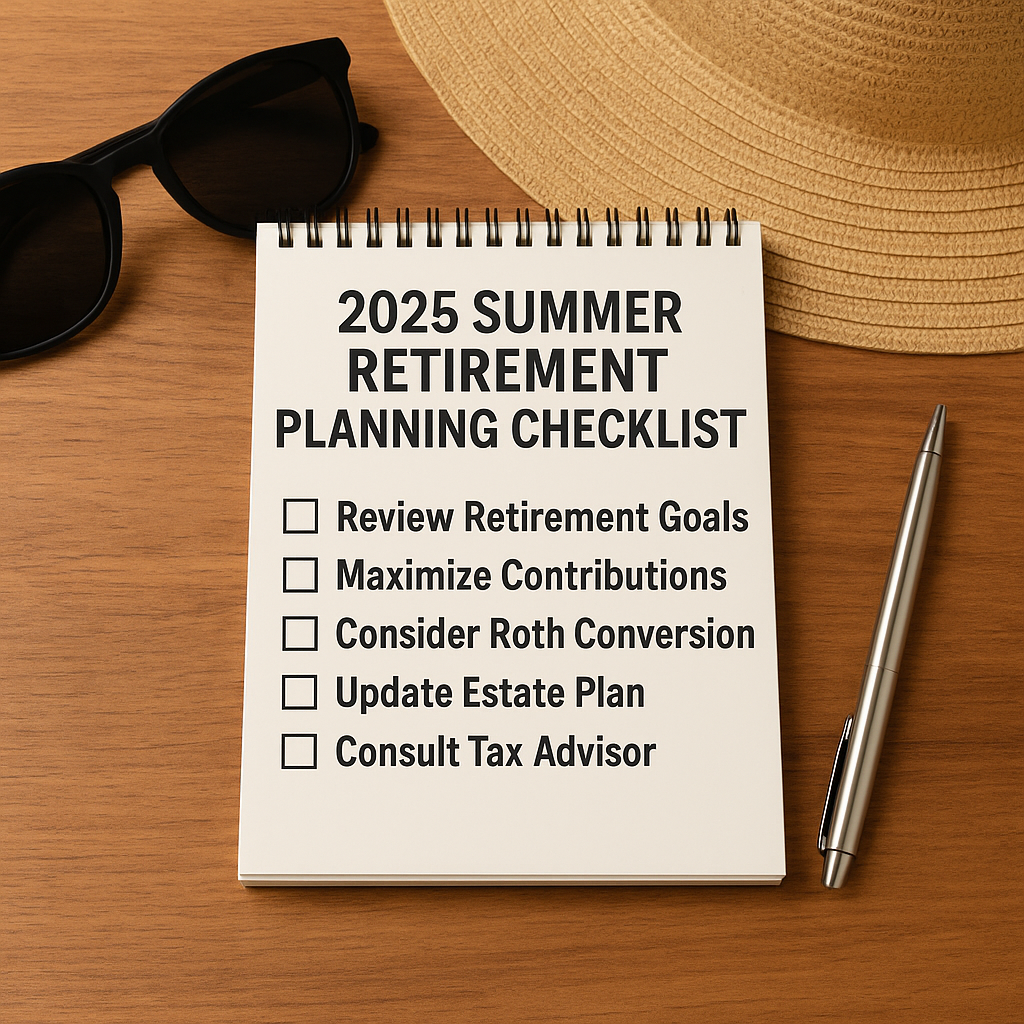

Read More2025 Summer Checklist: Is Your Retirement Plan on Track?

Summer’s a strange season for retirement planning. It’s when people slow down, take vacations, unplug a little. But maybe that’s why it works—less noise, more clarity. It’s a good time to sit with your finances and ask: Am I where I need to be? Let’s go through a practical summer checklist. Not everything will apply…

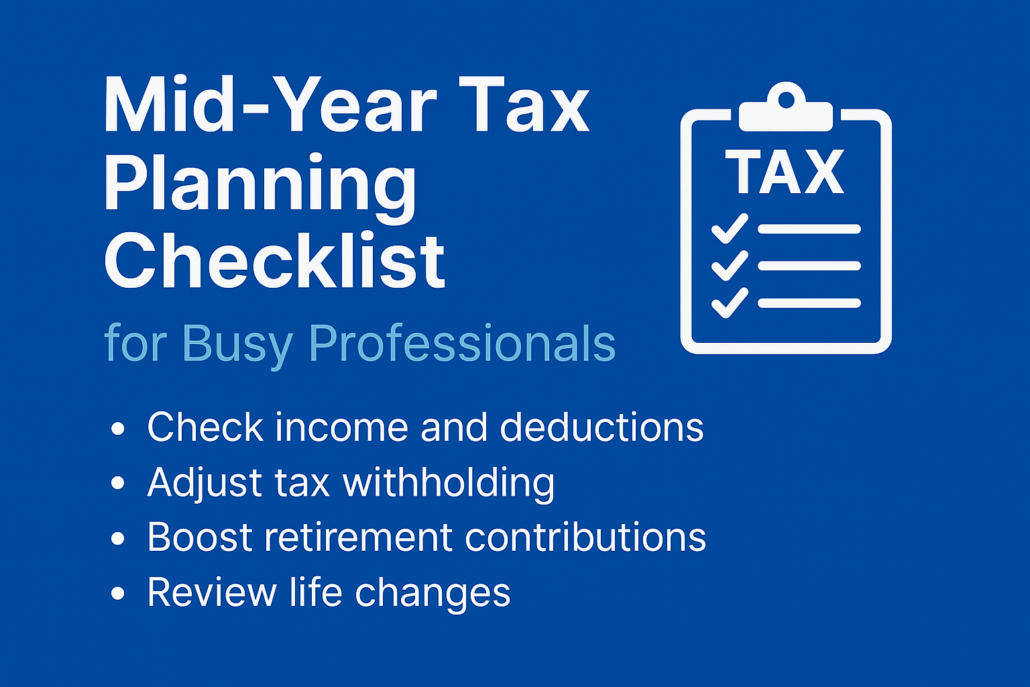

Read MoreMid-Year Tax Planning Checklist for Busy Professionals

By the time June rolls around, most people stop thinking about taxes. But that’s usually when things start slipping through the cracks. If you’re a busy professional, you already know how quickly the year can get away from you. And when it comes to tax planning, waiting until December—or worse, April—isn’t exactly a winning strategy.…

Read More