Posts Tagged ‘S corp tax planning’

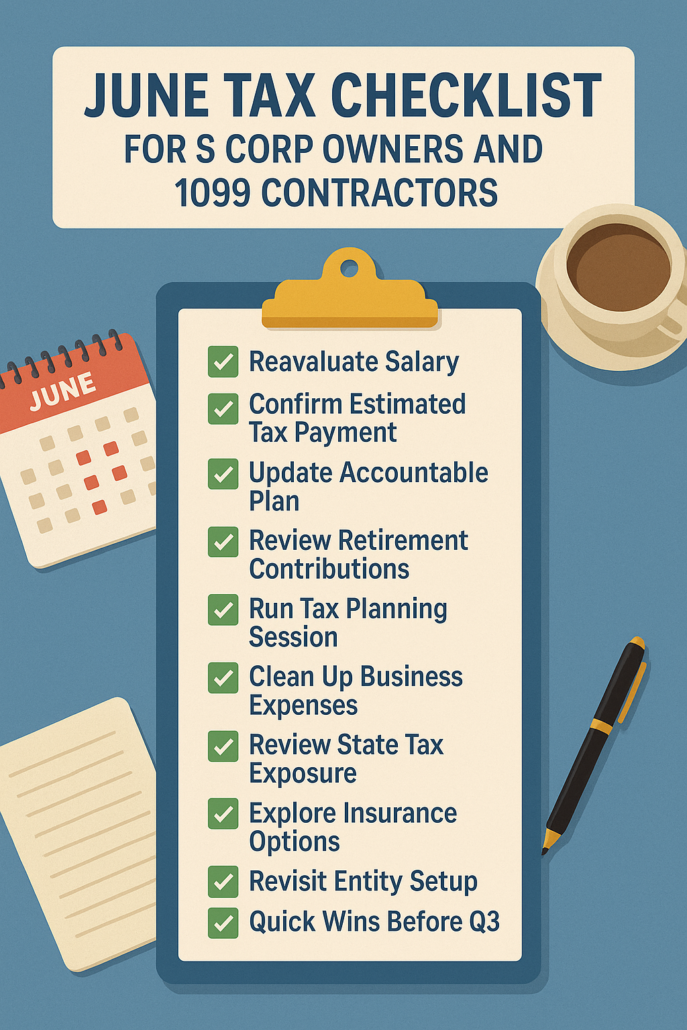

June Tax Checklist for S Corp Owners and 1099 Contractors: What You Need to Do Now

June doesn’t get much attention in the business world. It’s not tax season. It’s not year-end. But for S corporation owners and 1099 contractors, it might be one of the most useful months to reset. Quiet? Sure. But also—ideal for catching small problems before they become expensive ones. So if you’re running an S corp…

Read More