Posts Tagged ‘roth conversions’

10 Smart Summer Tax Moves to Shrink Your 2025 Bill Before It’s Too Late

Summer isn’t just for cookouts and vacations. It’s actually the perfect window—calm enough, early enough—to make smart tax moves before the year starts slipping away. You don’t have to overhaul your finances or spend hours in spreadsheets. But if you wait until the fall (or worse, winter), the choices shrink fast. This is about small,…

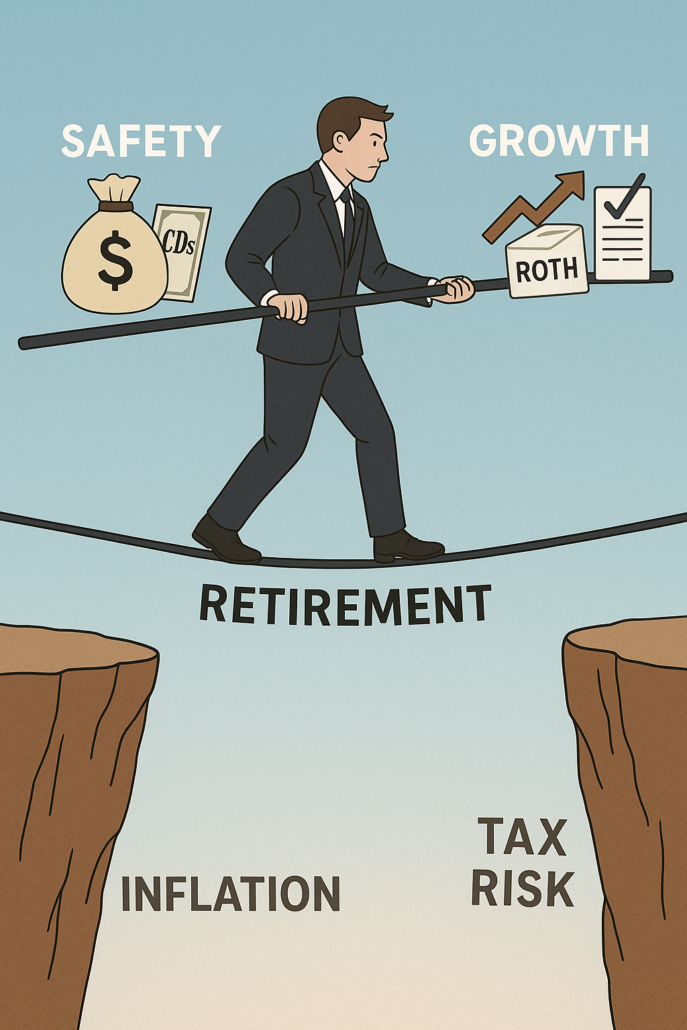

Read More4 Signs You’re Playing It Too Safe with Your Retirement

Playing it safe in retirement planning sounds wise. But being too cautious can quietly erode your wealth. Many investors, especially high-income professionals, overcorrect for risk—only to find themselves underprepared for rising costs, inflation, and tax burdens. If you’re too focused on protecting what you have, you might be missing out on sustainable growth, efficient tax…

Read MoreWhat to Do with Your RMDs (and What to Avoid)

Once you reach age 73, the IRS requires you to begin taking Required Minimum Distributions (RMDs) from your tax-deferred retirement accounts.If you were born in 1960 or later, your RMD start age is 75. RMDs apply to: Traditional IRAs SEP IRAs and SIMPLE IRAs (after retirement) 401(k)s, 403(b)s, and 457(b)s (unless you’re still working and…

Read MoreDon’t Fear Market Losses—Learn from Them

Market losses are part of investing. They’re frustrating—but also useful. Every investor experiences them. What matters is how you respond. Don’t freeze. Reflect. Seeing your portfolio drop can lead to panic. But reacting emotionally often makes things worse. Ask yourself: Was your risk tolerance overestimated? Did you follow a plan—or invest based on hype? Is…

Read More