Posts Tagged ‘RMD strategies’

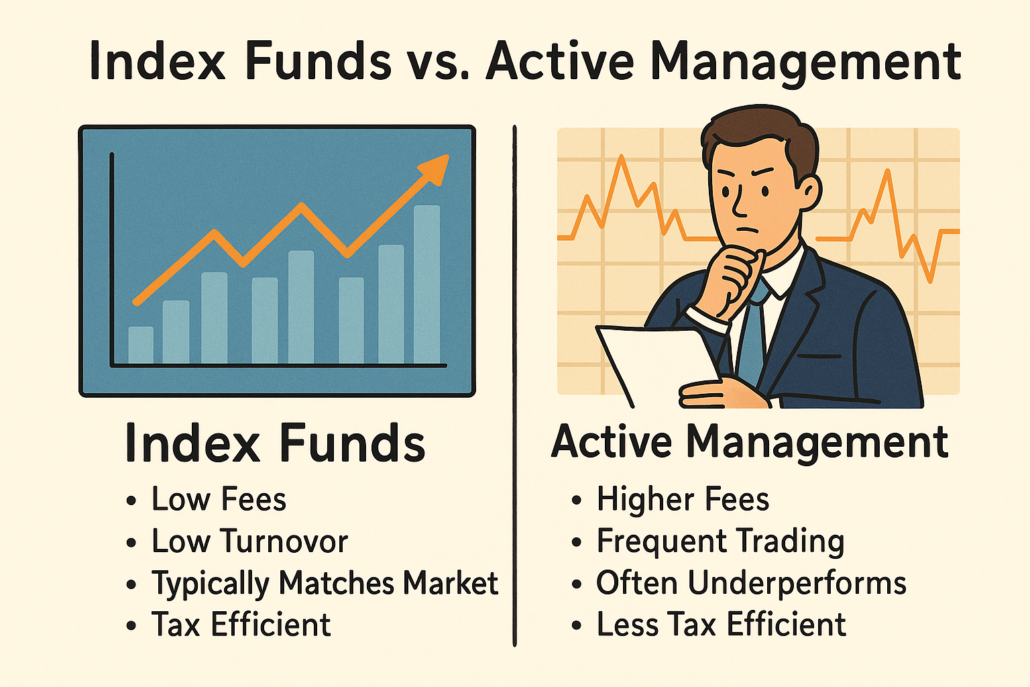

Index Funds vs. Active Management: What Really Wins

If you want to grow your wealth without unnecessary risk or tax drag, your investment strategy matters. For high-income professionals, especially physicians, choosing between index funds and active management isn’t just about returns — it’s about efficiency, control, and long-term outcomes. So, what actually wins in the long run? Let’s break it down. What’s the…

Read MoreWhat to Do with Your RMDs (and What to Avoid)

Once you reach age 73, the IRS requires you to begin taking Required Minimum Distributions (RMDs) from your tax-deferred retirement accounts.If you were born in 1960 or later, your RMD start age is 75. RMDs apply to: Traditional IRAs SEP IRAs and SIMPLE IRAs (after retirement) 401(k)s, 403(b)s, and 457(b)s (unless you’re still working and…

Read More