Posts Tagged ‘retirement income planning’

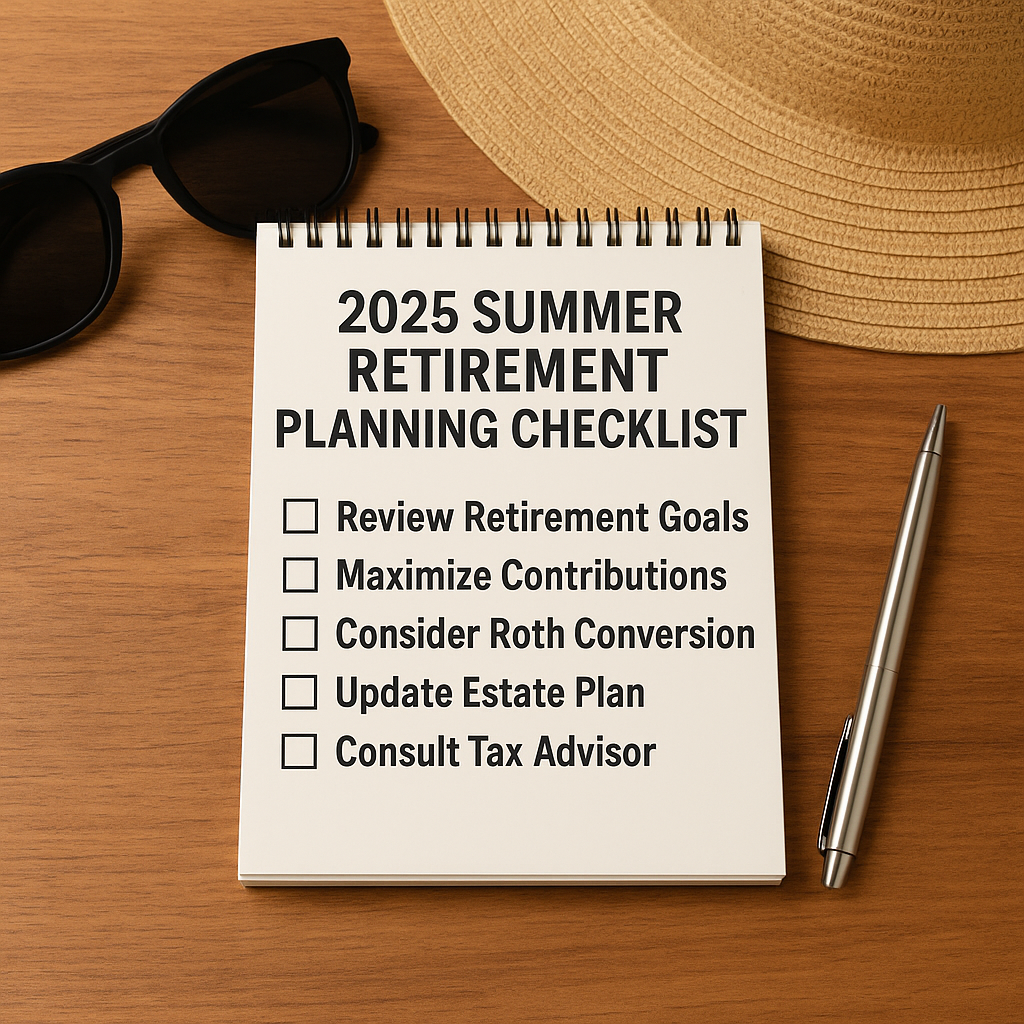

2025 Summer Checklist: Is Your Retirement Plan on Track?

Summer’s a strange season for retirement planning. It’s when people slow down, take vacations, unplug a little. But maybe that’s why it works—less noise, more clarity. It’s a good time to sit with your finances and ask: Am I where I need to be? Let’s go through a practical summer checklist. Not everything will apply…

Read MoreWhat to Do with Your RMDs (and What to Avoid)

Once you reach age 73, the IRS requires you to begin taking Required Minimum Distributions (RMDs) from your tax-deferred retirement accounts.If you were born in 1960 or later, your RMD start age is 75. RMDs apply to: Traditional IRAs SEP IRAs and SIMPLE IRAs (after retirement) 401(k)s, 403(b)s, and 457(b)s (unless you’re still working and…

Read More