Posts Tagged ‘mid-year tax planning’

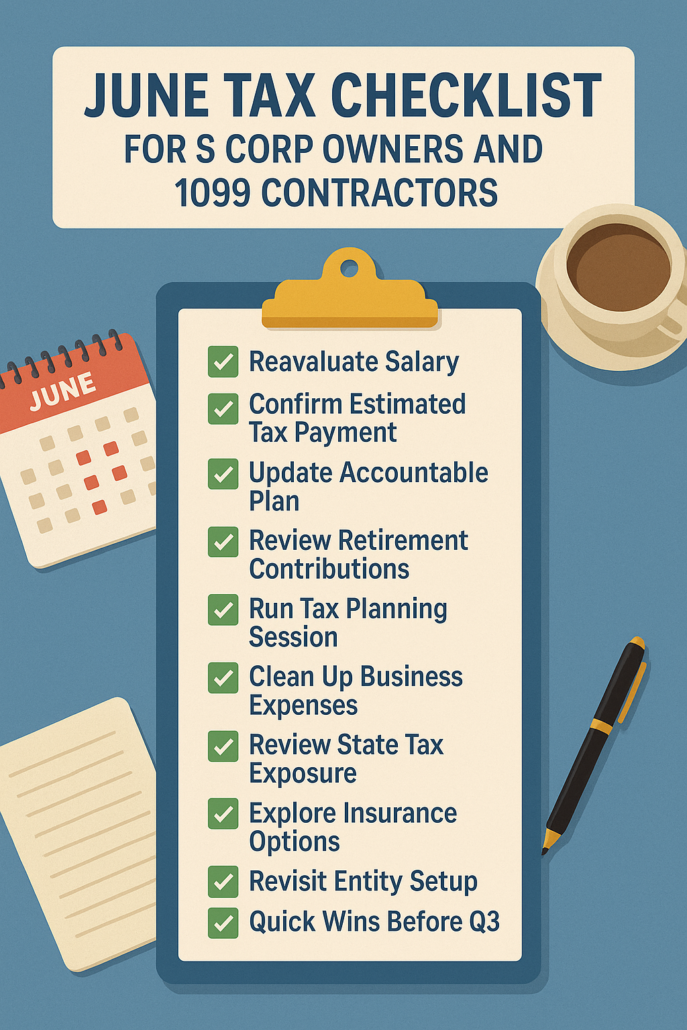

June Tax Checklist for S Corp Owners and 1099 Contractors: What You Need to Do Now

June doesn’t get much attention in the business world. It’s not tax season. It’s not year-end. But for S corporation owners and 1099 contractors, it might be one of the most useful months to reset. Quiet? Sure. But also—ideal for catching small problems before they become expensive ones. So if you’re running an S corp…

Read MoreMid-Year Checklist for 1099 Earners: Taxes, Deductions, and More

By the time June rolls around, most 1099 earners—freelancers, consultants, contractors—are already knee-deep in work. But what about taxes? The middle of the year is a critical checkpoint. It’s a moment to step back, evaluate, and adjust before things spiral toward year-end chaos. This checklist is for you if you’ve received non-W2 income and want…

Read MoreMid-Year Tax Planning Checklist for Busy Professionals

By the time June rolls around, most people stop thinking about taxes. But that’s usually when things start slipping through the cracks. If you’re a busy professional, you already know how quickly the year can get away from you. And when it comes to tax planning, waiting until December—or worse, April—isn’t exactly a winning strategy.…

Read More