Tax tips

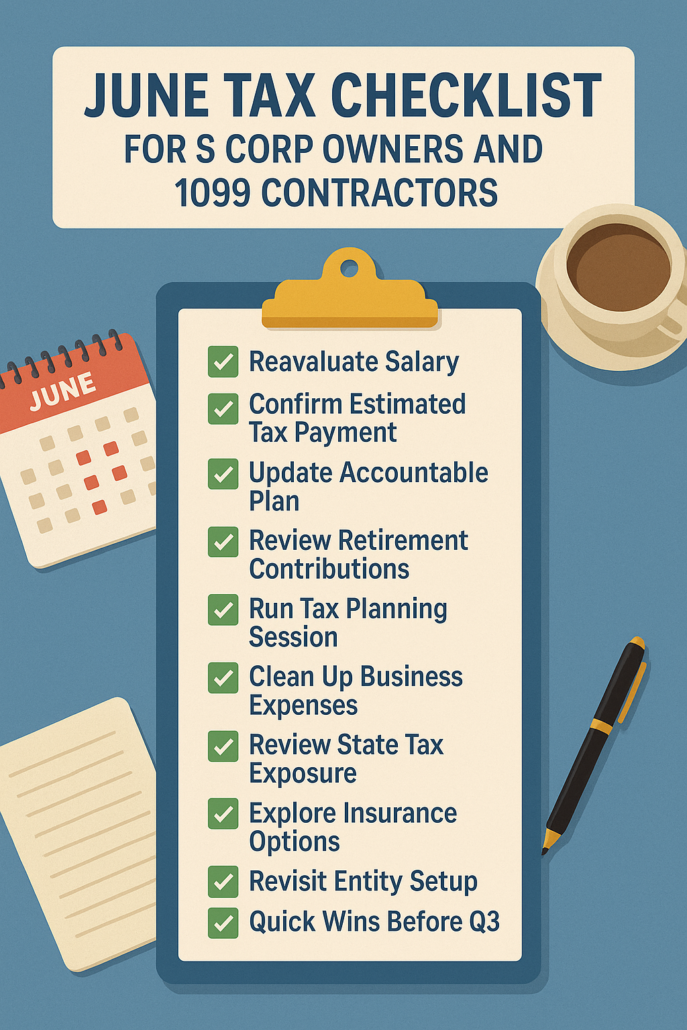

June Tax Checklist for S Corp Owners and 1099 Contractors: What You Need to Do Now

June doesn’t get much attention in the business world. It’s not tax season. It’s not year-end. But for S corporation owners and 1099 contractors, it might be one of the most useful months to reset. Quiet? Sure. But also—ideal for catching small problems before they become expensive ones. So if you’re running an S corp…

Read MoreWhat You Should Be Doing Right Now: Tax and Retirement Planning Mid-Year

We’re halfway through the year. That weird middle ground—too late to say “I’ll deal with it later,” but not so late that you’ve run out of options. If you’ve ignored your taxes or haven’t touched your retirement plan since January, now’s your window. Mid-year is when your numbers are real, not just guesses. And with…

Read MoreSummer Money Goals for High-Net-Worth Professionals: What to Prioritize Now

Summer’s a strange season for high-net-worth professionals. On one hand, things tend to slow down—colleagues and clients are on vacation, and the inbox gets a little quieter. But it’s also when smart financial minds get to work. While others are mentally at the beach, you can take advantage of the mid-year lull to tighten up…

Read MoreMid-Year Checklist for 1099 Earners: Taxes, Deductions, and More

By the time June rolls around, most 1099 earners—freelancers, consultants, contractors—are already knee-deep in work. But what about taxes? The middle of the year is a critical checkpoint. It’s a moment to step back, evaluate, and adjust before things spiral toward year-end chaos. This checklist is for you if you’ve received non-W2 income and want…

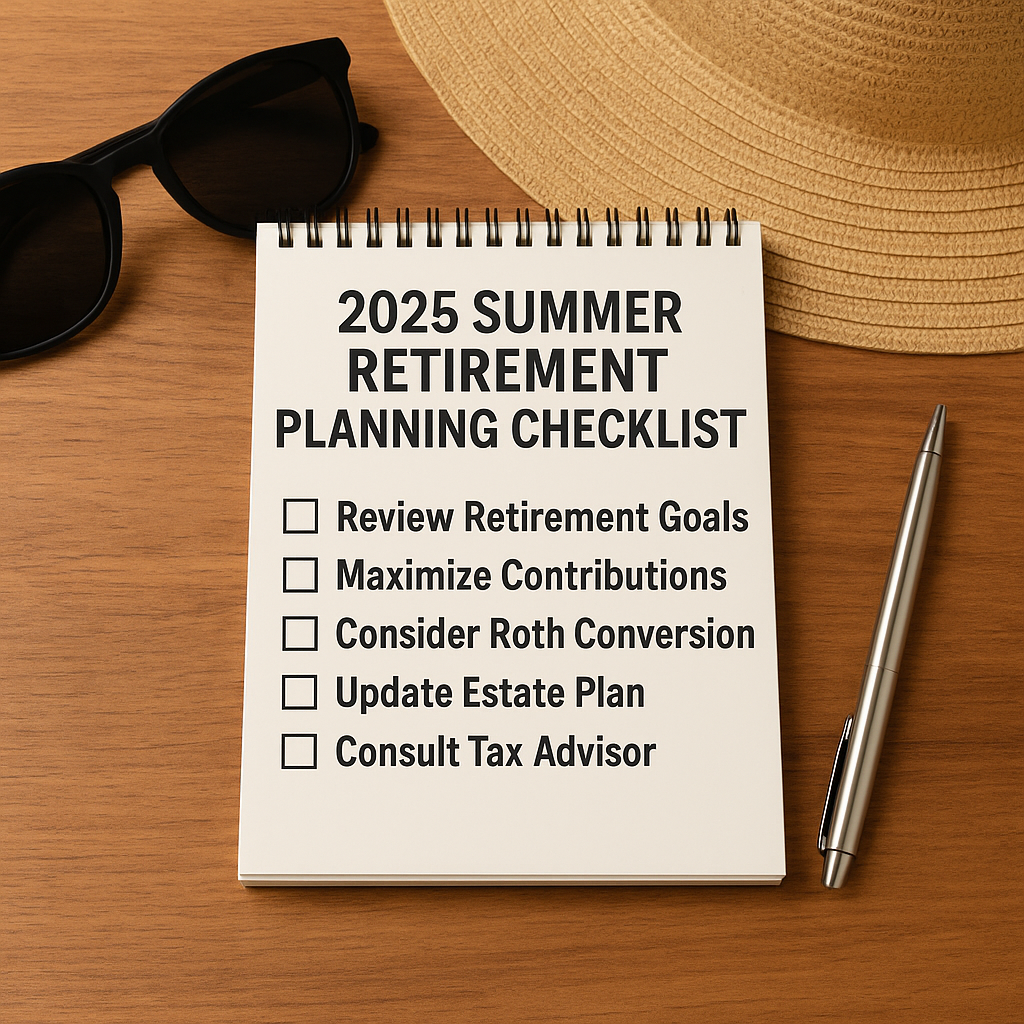

Read More2025 Summer Checklist: Is Your Retirement Plan on Track?

Summer’s a strange season for retirement planning. It’s when people slow down, take vacations, unplug a little. But maybe that’s why it works—less noise, more clarity. It’s a good time to sit with your finances and ask: Am I where I need to be? Let’s go through a practical summer checklist. Not everything will apply…

Read MoreRemote Medicine, Real Taxes: What Doctors Working Online Need to Know

The way physicians practice has shifted. If you’re delivering care remotely—full time or just supplementing your income—you’re operating in a different tax environment. One that requires more tracking, more strategy, and yes, more decisions. This guide walks you through what doctors working in telemedicine need to understand about taxes—and how to make it all work…

Read MoreTax Deferral Strategies Every High-Earner Should Know

When you’re earning well into the six or seven figures, taxes can feel like a slow leak on your wealth. You make the money, but you don’t always get to keep it—not right away, at least. That’s where tax deferral strategies come in. They don’t eliminate taxes, but they shift the timing. Done right, they…

Read MoreW-2 vs. 1099 for Doctors: Which Saves More on Taxes?

Not all income is treated the same—especially when you’re a physician. Whether you’re working as a full-time W-2 employee or contracting as a 1099 independent doctor, how you’re classified can make a real difference on your taxes, deductions, and long-term financial strategy. Let’s walk through what each option really means, what it costs you, and…

Read MoreMid-Year Tax Planning Checklist for Busy Professionals

By the time June rolls around, most people stop thinking about taxes. But that’s usually when things start slipping through the cracks. If you’re a busy professional, you already know how quickly the year can get away from you. And when it comes to tax planning, waiting until December—or worse, April—isn’t exactly a winning strategy.…

Read MoreManaging Your Finances Despite Trump Tariffs

The impact of tariffs, particularly those implemented during the Trump administration, has been felt by businesses and individuals alike. Whether you’re a business owner, an investor, or a consumer, these tariffs can affect everything from product prices to investment strategies. This blog will walk you through how to manage your finances during this turbulent time,…

Read More