Index Funds vs. Active Management: What Really Wins

If you want to grow your wealth without unnecessary risk or tax drag, your investment strategy matters. For high-income professionals, especially physicians, choosing between index funds and active management isn’t just about returns — it’s about efficiency, control, and long-term outcomes.

So, what actually wins in the long run?

Let’s break it down.

What’s the Difference Between Index Funds and Actively Managed Funds?

Index funds are designed to track a market index like the S&P 500. They’re passive, broadly diversified, and have minimal trading activity.

Actively managed funds try to beat the market by selecting specific investments. They involve higher turnover, higher costs, and more risk.

Quick comparison:

-

Index = passive, consistent, tax-friendly

-

Active = aggressive, costly, less predictable

-

Index = lower fees

-

Active = more hands-on management

If you’re a physician with multiple income sources, passive investing can reduce your taxable footprint. Learn how to manage taxes across income streams while maintaining a simple investment approach.

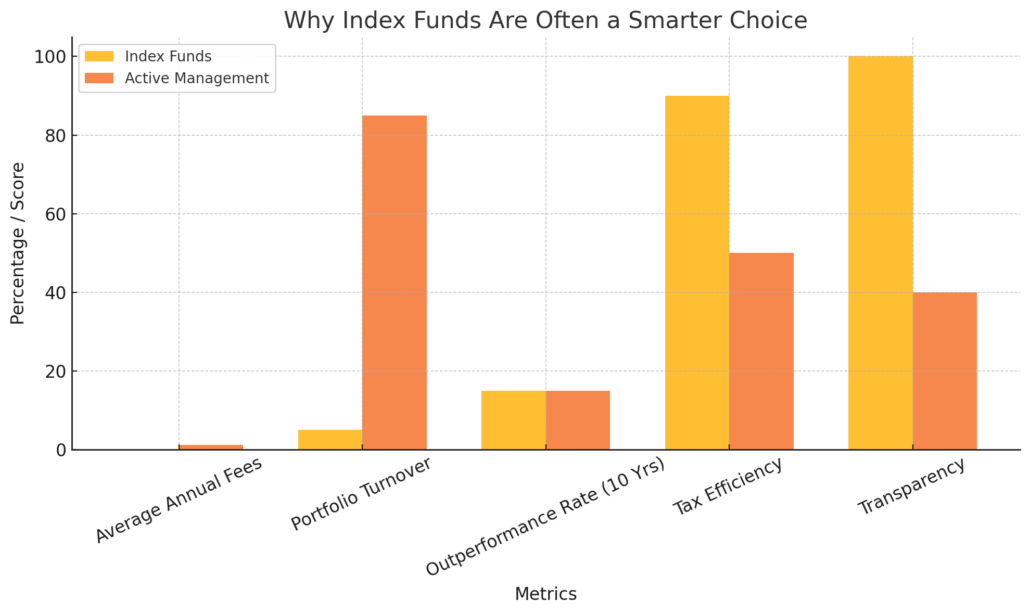

Do Active Managers Actually Beat the Market Long Term?

The numbers say no.

More than 85% of active fund managers underperform their benchmark over a 10-year period, according to long-term data from S&P Dow Jones Indices.

This underperformance gets worse after accounting for fees and taxes. Most gains are offset by:

-

Trading costs

-

Capital gains distributions

-

Management fees

Even if a fund beats the market once, it rarely does so consistently. Choosing an index fund means accepting market returns — which often outperform expensive guesses.

Why Are Index Funds Considered a Smarter Choice by Many Investors?

Because they offer:

-

Lower expense ratios

-

Broad diversification

-

Greater transparency

-

Long-term consistency

-

Less taxable turnover

You’re not betting on a manager — you’re investing in the market as a whole.

If you’re planning for retirement, passive strategies make required minimum distributions (RMDs) easier to manage. Lower capital gains mean fewer surprises during withdrawal years.

Are Index Funds Safer Than Actively Managed Funds?

They generally are.

Index funds spread risk across a wide range of securities. Active funds, on the other hand, often take concentrated bets that can backfire.

During market volatility, index investors tend to stay invested. Active investors may panic, sell at a loss, and trigger short-term capital gains — taxed at ordinary income rates.

For better results, consider how passive investing can support your retirement plan’s IRA and 401(k) strategy.

Which Strategy Has Lower Fees: Index or Active Investing?

Index funds win.

-

Many index funds cost as little as 0.03% annually

-

Active funds often charge over 1%

That difference eats into your returns.

Example:

-

$1 million invested for 25 years

-

7% return with 0.05% fee = ~$5.38M

-

7% return with 1.25% fee = ~$4.33M

That’s over $1 million lost to fees.

Reducing costs while maximizing after-tax growth is key for high earners. Check your strategy against IRS Publication 505 to understand withholding, estimated taxes, and the tax impact of investment income.

Can Active Investing Give Me Better Returns Than Index Investing?

Technically, yes — but the odds are low.

Even top-performing active funds rotate frequently. And high turnover leads to taxable events. Most active investors underperform net of fees and taxes.

If you’re contributing to a retirement account, keep your high-growth, high-turnover assets in a tax-deferred space like a Traditional or Roth IRA.

It’s also worth reviewing your IRA contribution limits to make sure you’re optimizing available space before investing in taxable accounts.

How Do Fees Affect Long-Term Investment Performance?

Fees erode your returns — quietly and consistently.

Even a 1% annual fee difference can result in hundreds of thousands lost over time.

If you’re running your own practice or side business, use these savings to reinvest or fund tax-efficient strategies like:

Your investment performance should be measured after fees, after taxes, and after planning.

Is It Worth Paying for a Fund Manager’s Expertise?

Rarely.

Even highly educated, experienced managers often fail to outperform. More importantly, their fees and tax consequences are usually higher than index funds.

Instead, pay for strategic tax guidance. Tax advisors help you:

-

Reduce capital gains

-

Delay income to lower brackets

-

Coordinate investment withdrawals with RMDs

-

Align your retirement planning with IRS RMD FAQs

The real edge is tax optimization — not stock picking.

What Are the Risks of Trying to Beat the Market?

You face:

-

Higher costs

-

Short-term thinking

-

Behavioral mistakes

-

Poor timing

-

Bigger tax bills

It’s tempting to chase performance. But history shows most attempts to beat the market fail — and leave you with higher RMD requirements later in life due to larger taxable account balances.

Even the best portfolio can’t overcome tax inefficiency. Learn to build retirement strategies around tax planning instead.

Why Do Most Professional Fund Managers Underperform the Market?

Because:

-

They incur high internal costs

-

They trade frequently

-

They respond to market pressure

-

They pay less attention to after-tax returns

-

They compete against each other

Active management may sound appealing, but the results often disappoint.

Focus on what you can control:

-

Fees

-

Taxes

-

Allocation

-

Behavior

When you optimize those, you stay ahead — regardless of market movement.

How Tax Advisors Help You Win With Index Investing

A tax advisor can:

-

Reduce your taxable gains

-

Map your withdrawals to low-tax years

-

Help you choose the best retirement account

-

Guide you through Roth vs. Traditional IRAs

-

Integrate your business income with tax-saving strategies

Their job isn’t to pick stocks — it’s to protect your wealth from erosion. Want to save more without sacrificing lifestyle? A tax strategy built around index investing can help you do exactly that.

FAQ: Index Funds vs. Active Management

Q: Can I use index funds in my 401(k)?

Yes. In fact, most 401(k) plans offer index fund options due to their low cost and long-term value.

Q: How do index funds impact RMDs?

Index funds generate fewer capital gains. This simplifies RMD calculations and reduces unexpected tax surprises.

Q: Is it smart to use both index and active funds?

Possibly. But for most investors, broad-based index funds paired with good tax planning are enough to meet long-term goals.

Q: What’s the best retirement account for index funds?

You can hold them in a Traditional or Roth IRA, 401(k), or brokerage account. Tax strategy should guide the placement.

Q: How can a tax advisor help reduce taxes on investments?

They help you optimize account selection, implement tax loss harvesting, structure income wisely, and avoid underpayment penalties through estimated tax planning.

Visit contact physiciantaxsolutions.com to schedule a consultation and learn how we can help you take control of your tax strategy today.

This post serves solely for informational purposes and should not be construed as legal, business, or tax advice. Individuals should seek guidance from their attorney, business advisor, or tax advisor regarding the matters discussed herein. physiciantaxsolutions.com assumes no responsibility for actions taken based on the information provided in this post.