Posts Tagged ‘physician tax strategies’

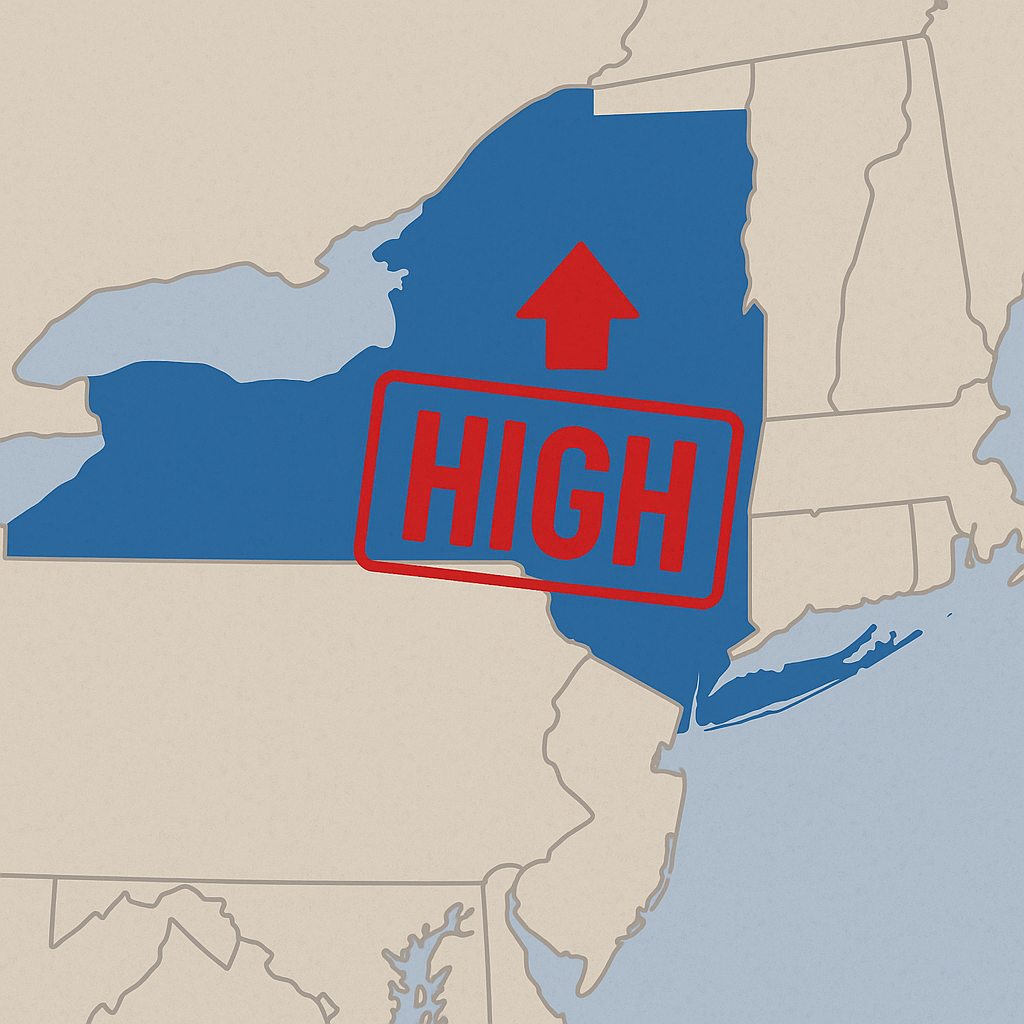

High State Income Taxes: How to Plan Smarter and Retire Wealthier

Understanding Why Some States Have Higher Income Taxes You might wonder why income taxes vary so much from state to state. The answer usually lies in how states balance their budgets. Some states, like California and New York, fund extensive public services with higher income taxes. Others, like Texas or Florida, skip income taxes but…

Read MoreDon’t Fear Market Losses—Learn from Them

Market losses are part of investing. They’re frustrating—but also useful. Every investor experiences them. What matters is how you respond. Don’t freeze. Reflect. Seeing your portfolio drop can lead to panic. But reacting emotionally often makes things worse. Ask yourself: Was your risk tolerance overestimated? Did you follow a plan—or invest based on hype? Is…

Read MoreHow Physicians Are Boosting Their Income Outside of Medicine

You worked hard for your medical degree. But more physicians are realizing that relying solely on clinical income may not be the most sustainable long-term path. You don’t have to trade all your time for money. Let’s look at how physicians across the country are building wealth outside the exam room—without giving up their identity…

Read More